Among the many tasks that entrepreneurs need to tackle when starting a business, figuring out how to choose the right business entity type stands as one of the most critical. A company’s business structure affects:

- Personal liability of the business owner

- Tax rates and rules

- Potential to raise money

- How profits and losses are distributed among owners

- Complexity and paperwork involved in setting up and operating the business

With so much riding on selecting the right business entity type, it pays to research the options thoroughly and get guidance from licensed legal, accounting, and tax professionals. It can also help to educate yourself by taking advantage of online resources that provide information. For example, I’ve conducted several webinars on the topic to help business owners gain a stronger understanding of the options that are out there and what they should consider as they weigh the pros and cons of each.

Let’s take a look at some of the highlights from each of the webinars. After you’ve had a glimpse of the insight they offer, I hope you’ll save them for future reference as you consider how to choose the right business entity for your entrepreneurial venture. And if you’re a professional services provider (such as a business consultant or coach, tax preparer, bookkeeper, accountant, lawyer, etc.), who helps entrepreneurs, these webinars offer information to aid in your efforts, too.

Webinars to Help You Decide Which Business Structure Is Best

1. Pros & Cons of Popular Business Entities: Sole Proprietorship, LLC, S Corp, and C Corp

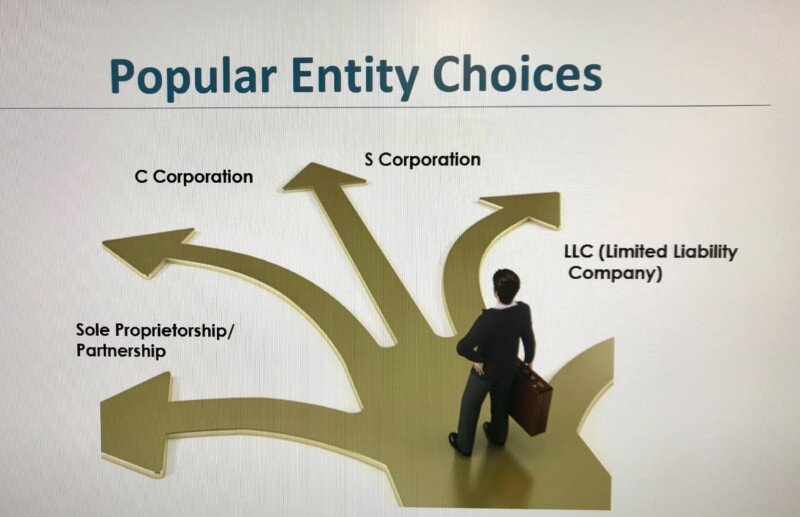

In this SCORE webinar, I discuss the most commonly selected business entity types and share some of the advantages and disadvantages of each. Here’s a quick overview:

Sole Proprietorship (or Partnership)

Sole Proprietorship Advantages

- Simple to form

- Simple to maintain

- Simple to tax

Sole Proprietorship Disadvantages

- A Sole Proprietorship offers no separation of personal and business assets

- Privacy of some personal information not protected

- Prevents building business credit and limits the ability to raise capital for the business

Limited Liability Company (LLC)

LLC Advantages

- An LLC offers simple formation and compliance requirements

- Personal asset protection for owners

- Tax flexibility

- More professional credibility than a Sole Proprietorship or Partnership

LLC Disadvantages

- Possible confusion over roles and responsibilities when the LLC has multiple owners (a.k.a., members)

- Possibly excessive self-employment tax burden for members if they don’t opt for S Corp tax treatment

- May not sell stock and may find it challenging to get backing by investors

S Corporation (Subchapter S Corporation or S Corp)

Note that the S Corporation is not a business structure on its own, but rather a tax election qualifying LLCs and Corporations can make.

S Corp Advantages

- Potential tax savings for LLCs because not all income is subject to self-employment taxes

- Potential tax savings for Corporations because tax flows through to shareholders’ personal tax returns, thus avoiding double taxation of some company profits

- Personal asset protection for members and shareholders

S Corp Disadvantages

- More compliance complexity than an LLC

- Higher formation costs than an LLC

- Eligibility limitations (e.g., C Corporations with over 100 shareholders don’t qualify.)

C Corporation (C Corp)

C Corp Advantages

- Personal asset protection for owners

- More growth potential than other structures (can sell multiple classes of stock and have an unlimited number of shareholders)

- Longevity (survives beyond its owners’ lifespans)

C Corp Disadvantages

- Costs more to incorporate than to form other business entity types

- Has more complicated compliance requirements

- Double taxation (Profits distributed as dividends are taxed at the corporate level and on shareholders’ individual income tax returns.)

This webinar also includes a diagram to walk you through a decision tree to help you visualize which of the entity types might warrant a more in-depth discussion with your attorney, accountant or tax advisor.

Note that the different structures have different initial filing and ongoing compliance requirements. You can find out more by watching the webinar or downloading the presentation transcript from the SCORE website.

2. Pros and Cons of Popular Legal Entities and When to File

This webinar, offered through Latino Tax Pro provides similar information to my SCORE webinar—and it goes a step farther. It also addresses the question, “When is the best time to form a business entity?”

Factors that Influence Choosing the Right Business Entity

Just as choosing the right entity type depends on various factors, when is the best time to file depends on a number of considerations, as well.

- Need for protection of owners’ personal assets

- Tax benefits

- Administrative complexity

When forming an entity mid-year, business owners will have two sets of tax forms to file for that tax year. For example, if a sole proprietor files to form a C Corp on July 23, the business owner would need to file a tax return as a sole proprietorship for January 1 through July 22 and also a tax return for the Corporation for July 23 through December 31.

One way to avoid the extra tax preparation work is to submit a delayed filing.

What is a Delayed Filing?

A delayed filing provides control over when a corporation or LLC goes into effect. In the states that allow delayed effective dates for business entities, entrepreneurs can set the date they want their company to be officially registered with the Secretary of State. By selecting a delayed effective date of January 1, a business gets a clean start at the very beginning of the new year, thus eliminating the need to file two sets of tax returns.

Advantages of a Delayed Filing

- It streamlines the tax filing process

- It allows entrepreneurs to avoid the end-of-year rush to submit business formation paperwork.

- It provides ample time to prepare for other startup requirements.

Not only can brand new business entities benefit from a delayed filing, but existing entities that want to change their entity type also can.

Keep in mind, however, if registering an entity will result in tax savings, it might be well worth filing as mid-year rather than requesting a delayed effective date. Also, if gaining liability protection of personal assets sooner rather than later is essential, then filing mid-year may be the best option.

How to Request a Delayed Filing?

The three steps involved include:

- Choosing the business structure

- Deciding on the effective date, and make sure the Articles of Organization or Articles of Incorporation reflect that date

- Submitting the required paperwork

Note that all states have registration paperwork with a designated provision for a delayed filing. If that’s the case, it might be possible to add one as an additional provision.

3. Should Your Clients Incorporate Now or in the New Year?

I presented this webinar for CPA Academy. It has helpful information for accountants who want to provide resources to their clients, and it’s also valuable to business owners who are considering forming an entity or changing their existing entity type.

Like the Latino Tax Pro webinar, it discusses the potential advantages of a delayed filing. It shares some additional details that I’d like to shed light on here.

Disadvantages of Waiting Until the Last Quarter to File Formation Paperwork

- States typically get inundated with business registration filings at the end of the calendar year.

- Paperwork that might typically take just a few weeks to process, could take a lot longer during the end-of-year rush.

- Waiting until December to register a business entity could result in the application getting tied up until February.

CorpNet Online Tools for Entrepreneurs

The webinar also shares some of the helpful tools on CorpNet’s website. For example,

- Our Business Structure Wizard – An online questionnaire that steps you through a series of questions to help identify which entity type might offer the most advantages based on your answers.

- Business Name Search – A free online tool that helps you identify if the name you want to use for your business is available.

- CorpNet’s Compliance Portal – A free online portal for monitoring compliance requirements and deadlines.

- Meeting Minutes Templates – Providing a foundation for creating a record of the various meeting minutes required of some entity types.

Also, the CPA Academy and the Latino Tax Pro presentations discuss the opportunity for CPAs and other professionals to provide additional value to their clients while earning extra revenue for their firms by participating in the CorpNet Partner Program.

4. How to Keep Your Clients in Compliance Throughout 2019

Being in the know about ongoing compliance is just as important as knowing how to choose the right business entity. I presented this webinar for AccountingCred to highlight some of the compliance requirements different entity types face.

A rundown of what it covers includes:

What is Corporate Compliance?

Corporate compliance means that a business entity is maintaining its good standing within the state(s) where it has been formed or given authority to do business. Besides the initial filings and tasks to operate legally, LLCs and corporations also have ongoing responsibilities that they need to fulfill annually or on some other schedule. Entities must meet all required external and internal business compliance rules.

Why is Staying Compliant Important?

Dire consequences can await entities and their owners if they fail to meet compliance requirements by their deadlines.

- State-imposed late fees and interest on payments owed

- Denied expansion into other states

- Negatively affect financing and business opportunities

- Risk losing liability protection of personal assets

- Dissolution of the entity by the state

What Must LLCs and Corporations Do to Stay Compliant?

The requirements vary by state and entity type. Below is a list of some compliance documents and filings that companies may need.

Internal Compliance Requirements

The state may not ask for these to be filed, but companies may need to have them in their records:

- Bylaws

- Board of Directors

- Annual meeting minutes

- Operating Agreement

External Compliance Requirements

The state or other authorities might impose the following items:

- Initial Report

- Annual Report

- Registered Agent

- DBA (a.k.a., fictitious name or trade name)

- Employer Identification Number (EIN)

- Franchise Tax

- Foreign Qualification

- Licenses and Permits

- Articles of Amendment

- Articles of Dissolution

The webinar goes into detail about these internal and external compliance requirements.

What Can You Do If the State Notifies Your Company that It’s Fallen into Bad Standing?

The process may vary depending on the state. Generally, the steps to take would be to:

- Contact the Secretary of State to identify why the entity has fallen out of compliance.

- File reinstatement forms with the Secretary of State office.

- Pay any outstanding fees to the state.

How Can Businesses Stay on Top of Their Compliance Responsibilities?

The webinar provides a state-by-state list for LLCs and Corporations. It identifies which states require an initial report or annual report, along with the filing deadlines.

It also touches on some additional state-specific compliance requirements that several states have enacted.

5. Business Incorporation and Compliance – What to Know for Your Firm and Clients

In this webinar, which is geared toward accountants and tax professionals, for Encoursa, I discuss the different entity choices that are most popular, along with their potential advantages and disadvantages. I also cover the importance of compliance and share some of the common filings, reports, etc. that different entity types may need to complete depending on the state they’re registered in.

In addition, I emphasize why it’s critical for business owners to keep their personal and business finances separate.

Key Takeaways About Separation of Business and Personal Finances

- Maintain separate checking, savings, and credit card accounts for business and personal use. It’s required for LLCs and Corporations. Plus, the separation between personal and business finances makes it easy to distinguish business revenue and expenses from personal funds and transactions, and it allows for a more organized tax preparation process.

- Pay taxes on time. Entities can fall out of good standing and face fines and penalties if they neglect their tax payments, including income tax, sales tax, business tax, or franchise tax. Realize that different states and different county and local jurisdictions may have other fees, as well.

Recap of How to Choose the Right Business Entity

The webinars that I’ve described all provide information to show you the consideration that needs to go into selecting a business entity.

To recap, the choice of business entity will affect:

- Business owners’ personal liability risks

- Taxes

- Funding opportunities

- Distributions of company profits

- Administrative responsibilities

Schedule some time to watch all of them.

- Pros & Cons of Popular Business Entities: Sole Proprietorship, LLC, S Corp, and C Corp

- Pros and Cons of Popular Legal Entities and When to File

- Should Your Clients Incorporate Now or in the New Year?

- How to Keep Your Clients in Compliance Throughout 2019

- Business Incorporation and Compliance – What to Know for Your Firm and Clients

I hope that you will glean something of value from each one. Whether you’re an entrepreneur preparing to talk with your lawyer or tax advisor about your options or if you’re a professional services provider who wants to help your clients become better informed, these webinars can help. And after you’ve decided on the right entity for your business, CorpNet is here to make sure your filings are done accurately and on time. Contact us today to talk with one of our team members!