The Launch Blog: Expert Advice from the CorpNet Team

How Many Members Can an LLC Have?

Besides personal liability protection, flexibility is among the top reasons entrepreneurs choose the Limited Liability Company (LLC) business structure for their companies. An LLC can have an unlimited number of owners, called “members” (with few restrictions on...

Can You File Your Own LLC?

Many entrepreneurs who want to form a Limited Liability Company (LLC) think they must hire a lawyer to handle the paperwork. They’re mistaken! While it’s helpful to consult an attorney about which business entity type is right for your business and get answers to...

The Top Reasons Startup Businesses Fail

No one starts a business to see it fail. Seeds of ideas slowly germinate into full-blown business plans bursting forth with sparkle and optimism. This business is your dream and you’ve given it your heart and soul. You know it won’t fail. I’m sorry to say that...

How to Calculate Profit Margins

Passion, energy, and enthusiasm are essential entrepreneurial traits for launching a business — and so is an understanding of financial performance. To sustain and grow an LLC or Corporation, a business owner must keep an eye on its profitability. Calculating...

What is a Business Statement of Purpose for an LLC or Corporation?

When starting a Limited Liability Company or C Corporation, businesses in most states must provide a written statement of business purpose in their formation documents (Articles of Incorporation or Articles of Organization). The business purpose statement describes...

Can I Use a Home Address for My LLC?

Is it OK to use your residential address as your business address, too? Here's what to consider before you use your home address to incorporate a business.

What Is Reasonable Compensation for an S Corporation?

If you're considering taking an S Corporation election, it's important that you review what obligations are involved in keeping an S Corporation viable. An important part of this review includes an evaluation of the reasonable compensation requirement. What is an S...

How Much Do Small Business Owners Really Make?

We all dream of having our own business, being the boss, and controlling our own destiny. I can assure you the dream is indeed possible. But will that dream, and future success be enough? How much do small business owners really make per year? And will it be enough...

What Is a BOI Report and Do You Need to File One?

Did you know many businesses will have a new federal reporting requirement in 2024? Most registered business entities — like Limited Liability Companies (LLCs) and Corporations — must file a beneficial ownership information (BOI) report with the Financial Crimes...

How to Manage Payroll for Restaurants

Maintaining an exceptional staff reigns as one of the essential ingredients for a successful restaurant. With hiring that staff, comes payroll responsibilities and complying with all related federal, state, and local employment and tax laws. Payroll for restaurants...

Incorporate Before Year End to Avoid Issues at the Secretary of State

Think you’re the only business owner who wants to incorporate or form an LLC before the end of the year with your Secretary of State? Think again. Registering a business at the end of a calendar year can take longer than any other time of the year. Because everyone...

When’s the Best Time of Year to Form an LLC?

Have you been thinking of launching a new business or changing your existing Sole Proprietorship to a formal business entity type like a Limited Liability Company, S Corporation, or C Corporation? Are you concerned that you might not be selecting the best time of...

How to Change Your LLC Address

If you change the principal business address or mailing address of your Limited Liability Company (LLC), it’s critical to update your information with the IRS, state, and local tax and licensing authorities. If you don’t, important tax and legal documents might go...

Year End Small Business Tax Tips

Before you let the hustle and bustle of the holiday season take over your business (and your life), now’s a good time to review your financial situation and explore some money-saving small business tax tips. Below is a list of my top tax tips entrepreneurs can...

Is Your Business in Compliance? Seven Questions to Ask Yourself

Maintaining a C Corporation or Limited Liability Company (LLC) is an ongoing process that requires constant attention. Unfortunately, most small business owners don’t know what they don’t know and busy entrepreneurs often find it tough to carve out time to research...

The Importance of Meeting Minutes

As the end of the year approaches, there are many things on a business owner’s plate that must be addressed. And while it may sound mundane, meeting minutes are one of them. Making sure proper minutes have been taken at meetings is critical for proving...

Don’t Be Nervous About Your Annual Business Review!

It's already November and we are rapidly approaching year's end. This means the time has come for an annual business review. What is an annual business review? You might think this is the annual report C Corporations and Limited Liability Companies (LLC) must file...

Business Closures, Dissolutions, and Withdrawals

It has been a rough few years for businesses across the country, but especially so for small businesses. From COVID-19 to inflation, companies of all sizes have had to close some or many of their locations. Whether you’ve had to close down entirely or shutter...

How to Start a Business in Wisconsin

If you're considering starting a new business in Wisconsin, there are a lot of reasons why this is a great option. Wisconsin offers a robust business ecosystem with a skilled workforce, business-friendly policies, and a central location in the U.S. It provides a...

A Guide to Small Business Taxes

No matter the type of business you operate, taxes are among the expenses you must anticipate and budget for. While not the most pleasant aspect of running a company, business taxes require an entrepreneur’s attention and follow-through because penalties exist for...

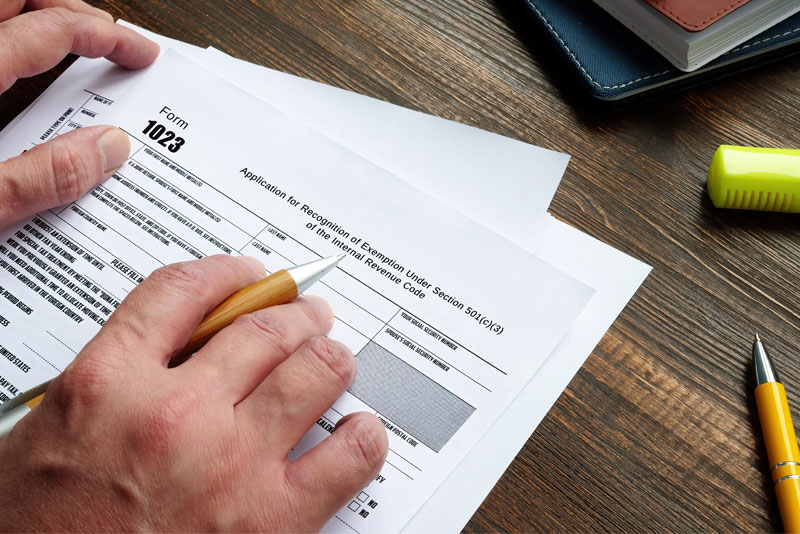

What Is Form 1023?

Filing formation paperwork with the state is just one step required to start a 501(c)(3) tax-exempt nonprofit organization. Federal income tax exempt status isn’t automatic. A nonprofit must file Form 1023, Application for Recognition of Exemption Under Section...

CorpNet Listed on Inc.’s Power Partner Awards for 2023

CorpNet is proud to announce that it has made Inc.’s Power Partner list for 2023. CorpNet is one of 389 companies to make the list. The Inc Power Partner award recognizes B2B companies that provide exemplary products and services for their partners. The award...

How to Start a Freelance Business

Starting a freelance business can put you on a path that leads to autonomy, creative freedom, and the opportunity to shape your professional destiny. Freelancing is not much different than building a small business, however, as a freelancer you work for yourself...

What Is a DUNS Number and How Do You Get One?

A Dun & Bradstreet (D&B) D-U-N-S® Number is a unique nine-digit number assigned to a company to help potential lenders, partners, and suppliers assess the business’s stability, creditworthiness, and other qualities. Having a DUNS Number can help a company...

Can You Get a Startup Loan for Your Small Business?

Starting a small business is exciting, but that alone is not enough. Achieving your goals will often require a long list of needs with money being at the top of that list. While most startups are self-funded, many entrepreneurs want and need a small business loan....

Should You Incorporate at Year End or Wait Until Next Year?

Should you incorporate year end or next year? It may depend on the state where a business is located and if the option of a delay effective date exists.

What Is FICA?

Business owners who hire employees must withhold, deposit, report, and pay Social Security and Medicare taxes per the Federal Insurance Contributions Act (FICA). FICA taxes are applied to all of an employee’s taxable compensation, which includes salary, wages,...

Annual Report List by State for LLCs and Corporations

Wondering if you need to submit a Secretary of State Annual Report and when it’s due? This state-by-state list will help you prepare and stay in compliance.

How to Sell Your Business Idea to Investors

Whether you’re in the early stages of a startup or looking to scale your existing business, the one hurdle many small business owners face is obtaining funding. While entrepreneurs in some industries may have an easier time, typically, it is challenging to sell...

Fall Tips To Help Your Business Have A Strong End-Of-Year Finish

Although most of the year has already passed and we’re now into the autumn season, don’t panic if your business has fallen a little bit behind on its goals. It’s not too late to make changes that can help lead to a strong finish in 2023. Whether you’ve just started...