Besides the questions of when and how to start a company, many entrepreneurs want to know where to incorporate a business. Each state has its own business laws and tax codes, so deciding where to form an LLC or a corporation should not be taken lightly.

I recently talked about this important topic in a webinar for accounting professionals hosted by CPA Academy. I want to share that information with you, too. It’s valuable food for thought whether you’re advising clients on their entrepreneurial journey or starting your own business.

Considerations When Choosing a Business Structure

Before getting into where to register a business, let’s take a moment to discuss some popular business structures and what to think about when deciding on the type of business entity to form.

Common business structures:

Here are a few things to think about when choosing a business entity type:

- Will the business have partners or investors?

- Do business owners want to limit personal liability for business activities?

- What are the company’s projected earnings and expenses?

- Do the owners want to minimize their self-employment tax obligations?

- What goals do the owners have for their business? (e.g., desire to expand, sell, or keep the company indefinitely, etc.)

- Do business owners want to keep paperwork and administrative requirements as simple and inexpensive as possible?

- Where will the company conduct its business?

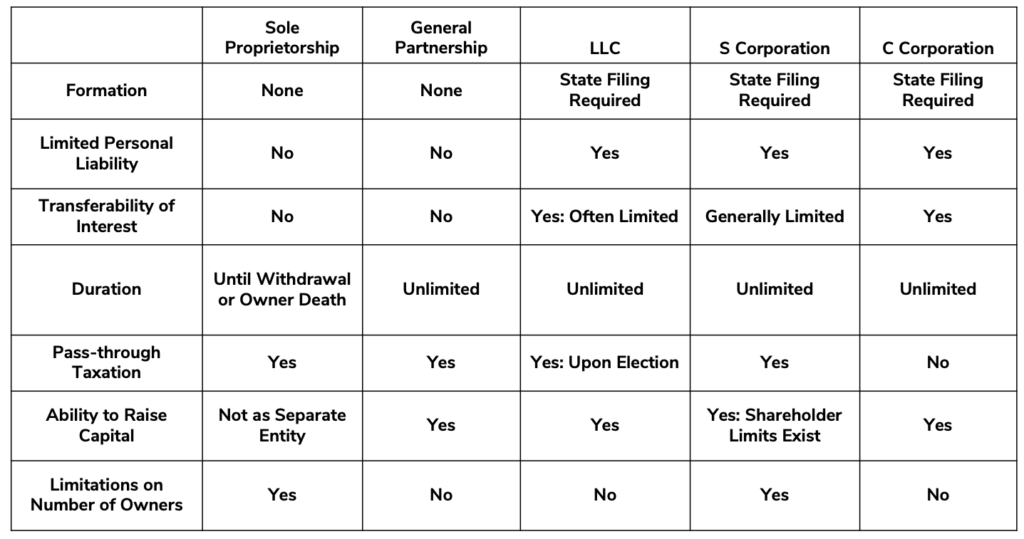

The chart below covers the tip of the iceberg regarding how the various business structures measure up. Business owners are wise to discuss their situation with an attorney and accounting professional so they can more fully understand the pros and cons of each entity type.

As you review the features of the various business structures, keep in mind that registering a business as an LLC or corporation offers multiple advantages over Sole Proprietorship and General Partnership options:

- Establishes a legal entity that’s separate from the business owner(s).

- Protects personal assets from liabilities of the business.

- Adds credibility.

- Has perpetual existence (i.e., the business can continue beyond the original owner’s lifetime or involvement in the company).

- Provides tax and management flexibility.

- Allows for more tax-deductible business expenses.

Considerations When Choosing a State for Registration

Just like choosing a business structure requires much thought, selecting the best domicile (home) state for a business also demands some brain power. Here are some factors to consider when deciding on where to incorporate.

1. Nexus

A thing called “nexus” plays a role in where someone must register their business. Nexus implies that a business has a connection to a state in some way. I know, that’s rather vague, and there is no uniformly shared definition of nexus across the 50 states.

The general criteria for determining if a business has nexus in a state are:

- The company has a physical presence, like an office, store, or warehouse, in the state.

- The company has notable economic activity without a physical presence in a state.

Most states have sales tax thresholds (more than 200 sales transactions or $100,000 in sales within the state annually) for determining if a company has economic nexus.

The rules for determining nexus change constantly. So, it’s critical that business owners research the regulations in any state where they might have nexus. If a company fails to register, pay taxes, or file reports in any state where it has nexus, it could face fines and other penalties. Moreover, it could jeopardize the business owner’s personal assets, too.

2. Formation Fees

The initial filing fees to form a business entity can vary from as low as under $100 to several hundred dollars depending on the state. Some states also require an initial report at an additional cost. Initial report fees also vary by state. Realize that although a state may charge more than others for business registration, it doesn’t mean the ongoing costs to operate a business there will be more expensive.

3. Annual Filing Fees

Some states require business entities to submit annual reports, which essentially confirm a company’s information on its incorporation paperwork is still valid. The fees for filing them range from under $50 to several hundred dollars.

A few of the other possible filings and fees include business license and tax registration renewals, amendments to incorporation documents, and a change of registered agent.

4. State Corporate Tax

Various states do not levy a corporate income tax on businesses; some also have no personal income tax. Keep in mind that a multi-state entity conducting business in a state without income taxes must still pay income taxes in any other states where they have operations if those states levy an income tax.

States without corporate income tax:

- Alaska

- Florida

- Ohio

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

States without personal income tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

5. Franchise Tax

In some states, business owners must file an annual franchise tax report and pay the associated tax instead of, or in addition to, an annual report and state income taxes. While the name sounds like this compliance requirement is for franchise operations like McDonald’s or Starbucks, it’s not! A franchise tax is a fee the state charges business entities for being registered to conduct business in the jurisdiction. How states calculate franchise tax varies.

Examples of how states calculate franchise tax:

- Arkansas – Franchise tax is based on the number of shares and par value.

- California – Franchise tax is based on a business’s annual income (even if it’s losing money), with a minimum charge of $800 annually.

- Delaware – Franchise tax is based on the number of shares and par value.

6. Privacy

The degree of public access to business owners’ information is another variable that differentiates states. For example:

- Florida makes business formation documents and annual reports available online to the public.

- Delaware does not require business owners to disclose their identities on their formation documents, thus allowing them to remain anonymous.

- Nevada is not bound to share business owners’ financial information with the IRS.

- Wyoming provides business owner identity protection with lifetime proxies.

7. Business-Friendly Legal System

The laws and court systems are more advantageous to businesses in some states than in others. This is a significant consideration because navigating red tape — such as excess compliance requirements and restrictive statutes — can create a lot of headaches for entrepreneurs.

Moreover, states with business-friendly climates may make it easier for entrepreneurs to attract investors like venture capitalists.

Three states are particularly known for having legal systems beneficial for businesses: Delaware, Nevada, and Wyoming.

Advantages of forming a business in Delaware:

- Delaware offers businesses flexibility in setting up their corporate officers and board structures.

- Corporate officers and directors do not have to live in the state.

- A corporation’s owner can serve as a one-person board of directors, whereas other states require at least three individuals to be directors/officers.

- Business owners, officers, and directors can maintain privacy because they don’t have to disclose key details about themselves when forming a business entity.

- Delaware has a commercial court system that uses judges (instead of juries) with high competence and experience in business law issues. It is known for its fair, impartial, and streamlined processes.

- Investors and banks have shown a preference for backing Delaware corporations.

- The state has favorable tax laws. For example, if a business is incorporated in Delaware but has its headquarters in a different state, generally, the company will not have to pay Delaware state income tax.

Disadvantages of forming a business in Delaware:

- The benefits of forming a company in Delaware are geared more toward large corporations than small businesses.

- Small business owners who live and operate their companies in a different state will incur extra formation and compliance paperwork and fees if they form a Delaware entity. Remember, if they live and run their business in their home state, they must also register their company there.

Advantages of forming a business in Nevada:

- Business owners can incorporate their companies in Nevada even if they do not live there.

- Nevada has no state corporate income tax, personal income tax, unitary tax, estate tax, gift tax, franchise tax, or admission tax.

- The state allows business owners and investors to remain anonymous. Their information is not required on Nevada’s business formation documents.

- Any liability a business incurs stays with the company. Business owners have more personal asset protection in Nevada than in many other states.

Disadvantages of forming a business in Nevada:

- Nevada has high incorporation fees and compliance-related costs compared to many other states.

- The state requires companies to obtain a state business license and renew it annually.

- Customers, vendors, investors, and others may perceive a business formed in Nevada but operated elsewhere as suspicious or illicit.

Advantages of forming a business in Wyoming:

- Wyoming offers management structure flexibility, so business owners have a great deal of control over how they run their companies.

- Incentives to incorporate in Wyoming include no corporate state income tax or franchise tax.

- Wyoming has a low sales tax rate of 4% (with exemptions for manufacturing equipment, agricultural products, and some other types of purchases).

- The state does not collect personal income tax.

Disadvantages of forming a business in Wyoming:

- If a non-resident business owner forms an entity in Wyoming but lives elsewhere, they may not reap as many benefits as business owners who reside in the state.

Incorporating in Your Home State vs. Out of State

When a company is considered to be conducting business in a state, it must pay taxes and comply with other reporting requirements there. So, if an entrepreneur lives — and will operate their business — in their home state, it’s typically best for them to form their LLC or corporation there. If they create their business elsewhere but conduct business in the state where they live, they will also have to register their company in their home state, which is a process called foreign qualification.

How do you know when a company is conducting business in a state? The definition of “doing business” varies by state, but typically it means a company meets one or more of the following criteria.

Here’s what qualifies as doing business:

- The company has a physical presence (office, warehouse, or retail store) in the state.

- The company holds in-person meetings with clients or customers in the state.

- The company is structured as a limited liability company, corporation, or limited partnership.

- The company has employees working in the state.

- The company has reached the sales threshold in the state.

Here’s what doesn’t qualify as doing business:

- The company is defending or settling a lawsuit in the state.

- The company conducts internal LLC or corporate business activities, such as member meetings in the state.

- The company has a bank account in the state.

- The company sells services or products through independent contractors in the state.

- The company secures and collects debts in the state.

- The company has engaged in isolated transactions that are completed within 180 days and not repeated in the state.

The bottom line: A company must be registered in each state where it meets the state’s criteria for conducting business or having nexus. That means complying with each state’s reporting, filing, fee, and tax requirements.

So, for most small businesses, the benefits of incorporating in a state other than their home state will be outweighed by the disadvantages of extra costs and administrative work.

How to Legally Do Business in Multiple States

Businesses registered in one state and doing business in one or more other states must complete the foreign qualification process in each of those other states.

A company will be considered a domestic entity in its home state (where it was initially created) and a foreign entity in the states where it has foreign qualified.

For Example: A company registered as an LLC and doing business in New York operates as a domestic LLC in that state. If that LLC also does business (e.g., has a physical presence, has employees, or reaches the sales nexus threshold) in Ohio, it must file for foreign qualification in Ohio to legally operate as a foreign LLC there.

How to Apply for Foreign Qualification

When a business has been created in one state and needs or wishes to expand to another, here are the general steps for foreign qualification. Keep in mind that the exact process for foreign qualification varies by state.

- Perform a Name Search – Business owners should conduct a name search in the state(s) where they wish to expand to ensure their business name is legally available. If another company has already claimed it, the business must register its foreign entity under a fictitious name.

- Obtain a Certificate of Good Standing from the Business’s Home State – Most states request that foreign entities provide a Certificate of Good Standing to verify the company has stayed current on its responsibilities in its home state. If a company has neglected to fulfill its home state’s compliance obligations, it will need to remedy any outstanding issues (e.g., pay back taxes, submit past-due reports, etc.) and file for reinstatement to regain compliant status.

- Designate a Registered Agent in the Foreign State – Business entities must appoint a registered agent (a.k.a. statutory agent or resident agent) in any state where they will register as a foreign entity. The registered agent has the authority to accept service of process (government notices and legal documents) on behalf of the business. Generally, an individual (at least 18 years old) or a company must have a physical address in the state and be available from 8 a.m. to 5 pm. Monday through Friday to serve as a registered agent.

- Prepare and Submit a Certificate of Authority – Business owners must submit a form called a Certificate of Authority to the state where they want to operate as a foreign entity. In some states, the form goes by other names such as Application for Authority, Application for Registration, or Application to Transact Business. The filing fees vary depending on the state.

- Register for Payroll Tax if the Business Has Employees in the State – If a business has employees in a state where it’s foreign qualified, it must register with that state’s tax agency, acquire a state income tax withholding number, get an unemployment insurance number, and withhold income taxes. Employers must withhold and deposit federal and state income taxes (and sometimes local taxes). (Note that payroll tax registration in the state where the employee lives and works is also required for remote employees.)

Businesses must also register with the state’s Labor Department and follow all employment laws, such as those regulating minimum wage, labor relations, workers’ compensation, and disability insurance.

Consequences of Not Filing for Foreign Qualification

Businesses run the risk of incurring penalties if they fail to foreign qualify when required to do so. After all, they are running their company illegally if they conduct business without official authorization from the state.

Possible penalties:

- Arrears payment of filing fees the company should have paid as a foreign entity.

- Fines and interest for the time the company was conducting business without being approved for foreign qualification in the state.

- Back taxes for the time the company conducted business without being foreign qualified.

- Ineligibility to sue other parties in the state. (Entities may not bring suit in states where they aren’t registered.)

Can You Move an LLC or Corporation to Another State?

If a business owner decides to relocate a business to a new state and keep the entity’s duration, domestication (also called domestication) is typically recommended. Domestication means the business’s charter moves to the new state and ceases to exist in the old state. Not all states allow domestication and those that do have their own rules and processes.

Steps for domesticating an LLC or Corporation:

- Apply for domestication in the new state.

- Dissolve the business in the state where it was initially chartered as a domestic entity.

- After the business has been domesticated to the new state, complete a foreign qualification filing in the original charter state if the company will continue to conduct business there as a foreign entity.

Documentation required for domestication in the new state:

- Articles of Domestication

- Certificate of Good Standing from the original domicile state (where the business was domiciled)

- Copy of the Articles of Dissolution the company will be filing with the original state

What’s Next?

As you can see, there’s much to consider — whether you’re a business owner or an accounting professional helping business clients — when deciding on the best state for incorporating a company.

I encourage business owners to use some of the tools CorpNet has created to help entrepreneurs navigate the complexities of launching and operating a business.

- Business Name Search Tool

- Business Structure Wizard

- Business Guides and Checklists

- CorpNet Compliance Portal

In addition, it’s critical that entrepreneurs seek expert legal and accounting advice to ensure they have the information they need to make an informed decision.

And CorpNet is here to help with the varied filing requirements — in all 50 states! Business owners, contact us for more information about how we can save you valuable time and give you peace of mind that your business formation and compliance documents are prepared and filed accurately.

Accounting professionals, consider becoming a CorpNet Reseller or Referral Partner to drive revenue to your bottom line as you secure expert business filing services for your clients.

Choosing a business structure can be a tough decision for the new business owner. CorpNet wants to make the process easier.

This free, online tool helps small business owners navigate the process of picking the right business structure for their new business.