Tax season is right around the corner. A lot has changed, tax-wise, in the past year due to new legislation. Here’s a quick look at what business owners need to know about filing their taxes in 2022.

Sole Proprietorship

Sole proprietors are unincorporated businesses with no distinction between the business owner and the business. The business owner is responsible for all the business’s debts, losses, and liabilities.

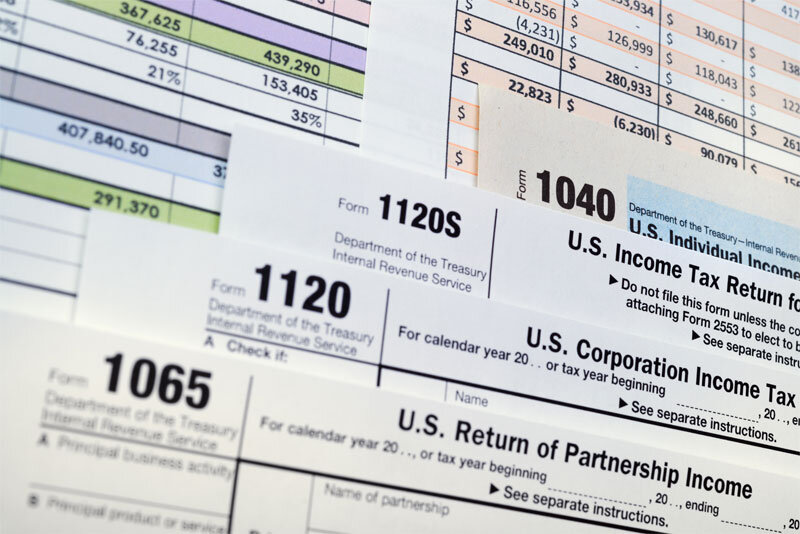

Business earnings are considered personal income, and at tax time, they need to file a Schedule C (IRS Form 1040) “Profit or Loss From Business.” The filing deadline for this year is April 18, 2022. If you file taxes in a state where the 18th is a holiday (Maine or Massachusetts), your filing deadline is April 19, 2022.

Also, most sole proprietors must submit estimated tax payments quarterly. According to the Internal Revenue Service (IRS), estimated taxes are for income that is not subject to withholding, including earnings from self-employment, investments, rentals, retirement plans, etc.

Although state income tax due dates vary, for sole proprietorships, the deadlines are the same as the federal tax deadlines.

Partnerships

Like sole proprietorships, there is no legal separation between the business owners and the company in partnerships. So business taxes are passed through to the partners, who are all deemed equal and are taxed equally by the IRS.

Partnerships use IRS Form 1065 (the U.S. Return of Partnership) to calculate and submit their profit or loss. On the form, partnership owners must list the business’s revenues and expenses and answer several yes or no questions about the company.

A partnership must also file a Schedule K, which breaks the partnership’s income into different categories, such as ordinary business income, rental income, and interest income. Next, the company fills out a separate Schedule K-1 for each partner where the partner’s share is listed.

The due date to submit Form 1065, Schedule K, and Schedule K-1 is the 15th day of the third month after the end of the partnership’s tax year. For partnerships using December 31 as their year-end, the partnership return due date is March 15, 2022. Also, partners are not employees and should not be issued a W-2 Form.

Limited Partnerships (LP) consist of general partners and limited (or silent) partners. General partners make business decisions, manage operations, and have personal liability for the company’s legal and financial debts. Limited partners may invest money or property in the LP but have no operational responsibility, nor are they personally liable. However, limited partners must also be listed on the Schedule K and receive a Schedule K-1 from the partnership for their tax filings. This is also the case for Limited Liability Partnerships.

As a side note: The Treasury Department and the IRS have updated the 1065 partnership form for the tax year 2021 (filing season 2022). The updates promise to simplify how partners compute their U.S. income tax liabilities regarding international tax matters and computing deductions and credits.

Limited Liability Companies (LLCs)

Whether the LLC is a single-member or multiple-member LLC, it is considered a separate entity from its members. By default, a single-member LLC is taxed like a sole proprietorship, with the same tax forms (Form 1040 and Schedule C) and deadlines. And, also by default, a multiple-member LLC is taxed like a partnership with the same tax forms and deadlines (Form 1065 and Schedule K and K-1).

LLC members can also elect to be taxed as a C Corp or an S Corp. If the LLC elects a C or S Corp status, different forms and due dates apply (see below).

C Corporations

C Corporations are separate legal entities from the business owners and file separate tax returns from the owners. Owners of C Corporations are considered employees of the corporation and must receive a W-2 from the corporation. C Corps operating on a calendar year basis file IRS Form 1120 (U.S. Corporation Income Tax Return). This year the deadline is April 18, 2022. For C Corps that don’t use a calendar year, the filing deadline is the 15th day of the fourth month following the end of their fiscal year. Typically, if corporations expect to pay more than $500 in taxes, they must make estimated tax payments using Form 1120-W.

Corporate income taxes are paid at a flat 21% corporate income tax rate. Basic information required on Form 1120 includes the corporation’s name, address, Federal Tax ID Number (EIN), list of assets, and profit and loss information. If you paid more than $600 for services to subcontractors and vendors who are not employees, you must also distribute Form 1099-NEC to them, usually by January 31 of every year. Then you must file Form 1096 to report these payments by the same deadline.

October 17, 2022, is the final extended deadline (if previously requested extensions) to file individual and corporate tax returns for the tax year 2021 using Form 1040 and Form 1120.

S Corporations

The S Corporation is a legal election offered to LLCs and C Corps, allowing the companies to be taxed as a partnership, avoiding the double taxation corporations experience. As in a partnership, all business income is passed through to the owners and taxed at the individual tax rate. As a bonus, S Corps maintain the personal liability protection available to C Corps.

S Corps file IRS Form 1120-S and this year, these returns are due March 15, 2022 (for those corporations operating on a calendar year) with an extended deadline of September 15, 2022. Again, if the corporation is not on a calendar year, the tax filing is the 15th day of the fourth month following the end of the fiscal year.

To be treated as an S Corp, the business must complete and file IRS Form 2553 no more than two months, and 15 days after the beginning of the tax year the election is to take effect, or at any time during the tax year preceding the tax year it is to take effect.

Tax Changes for 2022

- If your company received a Paycheck Protection Program (PPP) loan (forgiven or unforgiven), the money does not count as business income. In addition, you can write off eligible business expenses, even if the PPP loan was used to pay those expenses.

- Likewise, you do not have to count Economic Injury Disaster Loan (EIDL) Advances or EIDL loans as taxable income. And you can deduct any expenses covered by using these funds to lower your tax liability. (Plus, you are allowed to pay taxes using EIDL loan funds.)

- Remember, the EIDL loan agreement included your promise to maintain detailed records of how the money was used and to provide these records to the Small Business Administration (SBA) if required. While you may not get audited, don’t skip this critical step. Maintain your records and be prepared to respond if an audit occurs.

- Paid leave credit for vaccines: The American Rescue Plan Act of 2021 (ARP) allows small and midsize employers to claim refundable tax credits that reimburse them for the cost of providing paid sick and family leave to employees due to COVID-19. This includes leave taken by employees to receive or recover from COVID-19 vaccinations. ARP tax credits are available to eligible employers who paid sick and family leave from April 1, 2021, through September 30, 2021.

- Employee retention credit: ARP also extended the employee retention credit until December 31, 2021.

- Sick and family leave credits: Eligible employers can claim refundable tax credits that reimburse them for the cost of providing qualified sick and family leave wages for employees on leave between April 1, 2021, and September 30, 2021, either for the employee’s own health needs or to care for family members.

- Expansion of Charitable Gift Deductions: C Corps are still allowed to raise the limit for cash donations from 10% to 25% for the 2021 tax year.

- Business meal deduction: Business meals at restaurants are 100% deductible for tax years 2021 and 2022 (up from 50%).

- The standard mileage rate for business use of a vehicle is 56 cents for the 2021 tax year and 58.5 cents for the 2022 tax year.

- Business owners with no employees are eligible to contribute up to $58,000 in 2021 and $61,000 in 2022 to a one-participant or solo 401(k), with an additional $6,500 catchup if the owner is over 50.

- Payments from digital payment services: If you allow customers to pay for goods or services through a digital payment service such as PayPal or Venmo, be aware that starting in 2022, if you’ve received more than $600 through these services, they are required to report the income to the IRS.

Are you thinking about changing your business structure in 2022? Let CorpNet guide you through the process. We have agents standing by to help!