Once entrepreneurs taste what it’s like to be their own boss and carve their own career path, some decide to pursue starting multiple businesses. Depending on the situation, owning multiple Limited Liability Companies (LLCs) might make sense. Which leads to the question, how many LLCs can someone have?

The short answer is there are no particular limits on how many LLCs someone may form, provided they meet all of the eligibility criteria to be an LLC member and comply with all of the federal, state, and local government rules and regulations for operating an LLC.

In this article, I’m going to discuss four ways to set up multiple companies using the LLC business structure:

- Set up one LLC and run multiple DBAs under that LLC

- Set up multiple LLCs for each separate business

- Form an LLC as a holding company and set up multiple LLCs under that company

- Establish a Series LLC

First, a cautionary note: Because of the many legal and tax nuances and details involved when starting a business (whether just one or several), it’s crucial for entrepreneurs to get expert guidance from a trustworthy, knowledgeable attorney and tax advisor. Making an informed decision from the start can help avoid pitfalls and headaches down the road!

What Is an LLC?

An LLC is a popular business structure because it combines the liability protection offered by incorporation while retaining some of the tax advantages of a Partnership or Sole Proprietorship.

To form an LLC, business owners must file business registration paperwork with the state. An LLC is considered a pass-through entity for income tax purposes, which means its profit and losses flow through to the business owners’ (“members”) individual tax returns. From a legal perspective, an LLC is separate from its members. This means that the LLC members have a degree of personal liability protection; generally, they are not personally responsible for debts and claims against the business. In other words, if the company is under financial hardship or named in a lawsuit, the business owners’ personal assets are not at risk. However, there are exceptions to this. Suppose owners do wrong intentionally or fail to follow business compliance rules. In that case, a court might determine they “pierced the corporate veil” that protects them.

Option 1. Create DBAs Under One LLC

“DBA” is the abbreviation for “Doing Business As.” Other names for DBA are fictitious business name, assumed business name, and trade name. What is a DBA? It’s a name that’s different from the legal name of the company. Business owners use DBAs when they want to market their company to the public and customers under a name other than the company’s legal name.

Filing a DBA lets the public know the true owner of a business. It helps to protect consumers from unscrupulous business owners who might try to operate under a different name to avoid legal trouble or escape a negative reputation.

In the case of an LLC, filing a DBA (or several DBAs) enables a company to operate multiple businesses without creating separate legal entities for each one.

Let’s imagine a business owner has formed an LLC for her retail store called “Fashion Accessories by Liz, LLC.” Now Liz wants to set up an online clothing boutique under the name “Dress Like You Mean It.” The LLC could file a DBA for that name, which, if approved by the state, would enable Liz to market and manage each business line separately (each accepting payments and writing checks in its independent name, etc.).

DBA Example for Business Owner Liz

Advantages of a DBA

The DBA route is a relatively simple way to structure several businesses under the same ownership. Below are some of the advantages of filing a DBA.

- Helps keep businesses in good standing with the state

- Costs less than paying to form and maintaining multiple LLCs

- Has fewer compliance formalities than registering a separate business entity

- Uses the Employer Identification Number (EIN) of the LLC (no additional EIN for the DBA)

- Satisfies bank requirements for opening accounts in the business name

- Receives the same personal liability protection as the registered business entity

- Makes filing income taxes easier since the DBA is rolled into the LLCs.

- May deter competitors from using the business name

State and County Nuances for Filing a DBA

Specific requirements for filing a DBA vary from state to state–and sometimes even from county to county. In some states, DBAs are registered with the State Secretary of State or other state agency. DBA registration is handled at the county level in other states, and each county may have different forms and fees for the process.

Some states require DBA filing at the county level:

- Arkansas

- California

- Colorado

- Delaware

- Georgia

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Michigan

- Nevada

- New Jersey

- New York

- North Carolina

- Rhode Island

- Tennessee

- Texas

- Virginia

- West Virginia

Seven states require companies to publish their fictitious business names in an approved newspaper or recognized legal publication once the DBA is approved:

- California

- Florida

- Georgia

- Illinois

- Minnesota

- Nebraska

- Pennsylvania

Fourteen states don’t require a DBA filing at all:

- Alabama

- Alaska

- Arizona

- Delaware

- Florida

- Hawaii

- Kansas

- Maryland

- Mississippi

- New Mexico

- Nebraska

- Ohio

- Wisconsin

- Wyoming

When to File a DBA

Generally, it’s wise for business owners to register a fictitious name before conducting any business using the name. Since a DBA is usually a prerequisite to opening a bank account for the business or using the name in contracts, it usually best to get it done upfront. Some jurisdictions will allow business owners to file DBAs within a short period after they’ve already begun to use the name to conduct business.

DBA Restrictions and Potential Disadvantages

Keep in mind some potential limitations and downsides that come with using DBAs for multiple businesses.

- Using DBAs does not establish separate legal entities. Therefore, an LLC and all DBAs under it are liable for their own and each other’s legal and financial troubles.

- Businesses may not use any terms (such as “Inc.,” “LLC,” or “Corporation”) after the fictitious name that implies a DBA is a registered business entity.

- Each state has its own rules regarding words prohibited in business names. Some words may not be allowed under any circumstances, while others may require special approvals.

- An issuing agency might deny a DBA application if the name requested is the same as (or too similar to) the name of another business—particularly if it will operate in the same area, compete for the same customer base, or is protected by a trademark registered by another company. In other words, if a DBA might create confusion about whom customers are doing business with, the request to register it might be rejected.

Option 2. Set Up Multiple LLCs

Using my earlier example of Liz and her business, setting up multiple LLCs would mean she would form two legal business entities: Fashion Accessories by Liz, LLC and Dress Like You Mean It, LLC.

Example of Multiple LLCs

Both LLCs would be their own separate legal and tax-paying entities. Neither would be liable for the other company’s legal or financial debts.

Advantages of Separate LLCs

This approach to setting up multiple companies may be attractive to people who want to isolate each of their businesses’ legal and financial risks to its own liabilities rather than assume the risk of all of the entrepreneur’s business operations.

- Helps entrepreneurs minimize liability risks of each individual business

- Allows real estate investors to protect each individual investment from the potential liabilities (slips, falls, etc.) of the other properties

- No limit to how many LLCs one person can form

Potential Disadvantages of Forming Multiple LLCs

Of course, with the positives, there can be negatives to forming separate legal entities for each business.

- Involves multiple business formation fees and paperwork

- May require managing multiple annual reports

- Requires paying multiple annual maintenance fees

- Requires obtaining separate business licenses and EINs for each business

- Requires filing tax forms for each LLC

Option 3. Form an LLC Holding Company with Multiple LLCs Beneath It

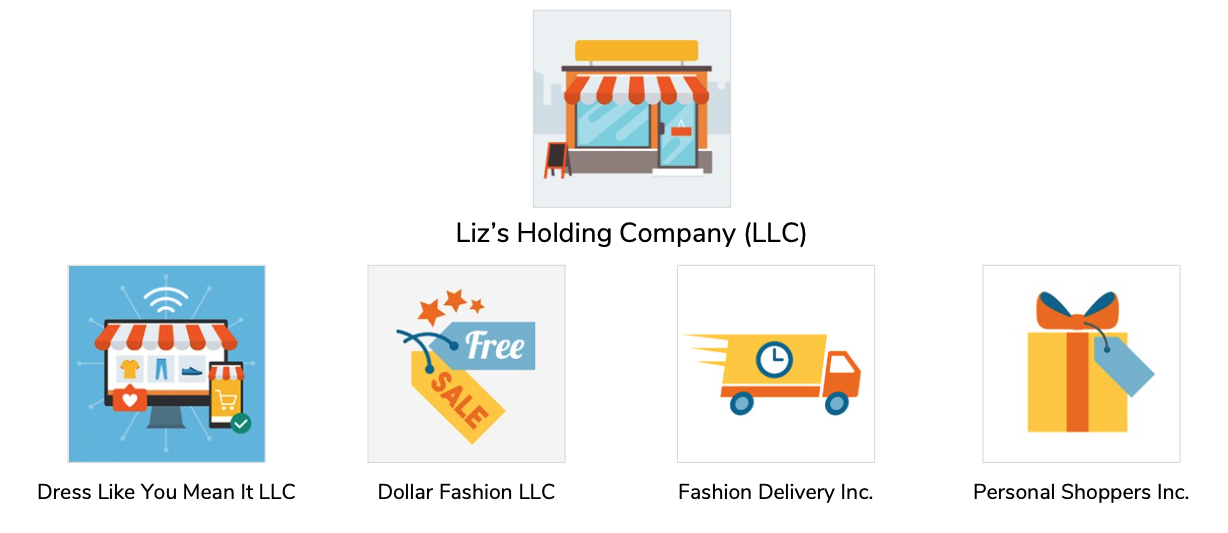

This approach involves one LLC as a holding company that forms other LLCs beneath it. This scenario is commonly used when companies intend to spin off one or more of their businesses or when they are looking to be acquired. It’s also popular with established companies that are looking to start a new business, and the existing company will fund the new venture.

What would a holding company look like using the hypothetical business example I used in the other sections of this article? If Fashion Accessories by Liz, LLC is set up as a holding company, it would form Dress Like You Mean It, LLC beneath it. She might also set up other LLCs beneath the holding company if she decides to venture into other lines of business and wants to centralize control over those entities.

Example of a Holding Company

Advantages of Using a Holding Company

Here’s a summary of the possible benefits of the LLC holding company approach:

- Enables an existing company to fund new businesses that the owner wants to launch

- May make it easier to sell off business lines to another company

- Centralizes control over multiple business ventures

- Protects individual lines of business from the financial and legal liabilities of the others

- Provides growth flexibility

Disadvantages of the Holding Company Approach

Using a holding company comes with more complex legal requirements. Also, income tax filing is more complicated.

Option 4. Form a Series LLC

A series LLC (SLLC) allows multiple LLCs to operate within a master LLC. An SLLC is not a holding company (although a holding company could be a series LLC). Each LLC in the series operates separately with its own name, bank account, and records. Each individual series may conduct business independently because the articles of organization for the series LLC explicitly allows for unrestricted segregation of membership interests, assets, liabilities, and operations across all LLCs in the SLLC.

Different members and managers might run each series, and their rights and responsibilities might vary from series to series. Each individual series may secure contracts, own property, sue, and be sued without affecting the other series under the SLLC.

What would our pretend business Fashion Accessories by Liz, LLC look like as an SLLC? Fashion Accessories by Liz, LLC would be considered the Series LLC, and then Dress Like You Mean It, LLC would be a series within that SLLC.

Example of a Series LLC

Advantages of an SLLC

The SLLC approach offers some benefits similar to setting up independent LLCs or a holding company, and it has some unique advantages, too. Perhaps the most significant advantage relates to the liability protection it provides.

- Protects each individual series’ assets from the liability risks of other series under the master series LLC (similar to how subsidiaries under a corporation are protected)

- Requires just one formation filing fee, no matter how many series are involved

- Provides liability protection for individual businesses without the cost of setting up new legal entities for each series

- Offers a good deal of flexibility and simplicity

Business owners such as real estate investors, franchisees, and other companies with distinct profit centers might find forming an SLLC appealing.

Disadvantages of the Series LLC

So, what could be the possible downsides? Not all states allow the formation of series LLCs, so the structure is not an option for everyone everywhere.

The only states that currently allow SLLCs are:

- Delaware

- Illinois

- Iowa

- Nevada

- Oklahoma

- Tennessee

- Texas

- Utah

How to Form a Series LLC

Forming a series LLC works similarly to forming a traditional LLC. It involves filing articles of organization in the state for the master LLC. Also, the state will most likely require that the articles of organization explicitly express that the LLC is authorized to form series under it. Additionally, the SLLC owners should create operating agreements to document the rules for the overall operations of the master LLC and each series to be formed as part of it.

Compliance Is Key

Regardless of the approach business owners take when starting and operating multiple businesses, it’s vital to stay compliant with their state’s rules. The extent of the requirements and amount of paperwork and fees involved will vary depending on the structure used for setting up the different businesses. Below I’ve listed a few of the considerations.

- Maintain a registered agent

- File an annual report

- Hold an annual meeting and record meeting minutes

- Renew business licenses and permits

- Withhold, report, and remit payroll taxes (if hiring employees)

- Report and pay applicable federal, state, and local taxes

- Filing articles of amendment to notify the state of any significant changes to the business entity

Whether these items and others are required for a single entity covering all of the entrepreneur’s other businesses or they must be submitted for each individual business that the entrepreneur operates will depend on how the multiple businesses are structured.

Confusing? It can be! This is why it’s critical for people to talk with an attorney and tax advisor for guidance and insight.

Set Up Your Businesses for Success

My expert team is here to help you prepare and submit all of your LLC filings and other business compliance paperwork—no matter where you are in the United States. We’re also an authorized registered agent in all 50 states, which makes things ultra-convenient if your business entities will expand beyond your home state. Contact us today to find out how we can save you time, eliminate unnecessary costs, and give you peace of mind that your filings get completed accurately.

Download the presentation slides ->

Watch My Educational Webinar

I recently recorded a webinar on how to structure multiple businesses. a video recording is below, along with the presentation slides.