Many business owners operate multiple businesses and there’s a good reason for that. Once you have one business and business structure in place, it’s much easier to get a new business off the ground than if you had to start from scratch each time.

At some point in your entrepreneurial life, you may come upon an idea or opportunity too good to pass up. But you have no intention to stop operating your current business. So, the question becomes how should you structure the new business. Should it be a part of the original business, a DBA (Doing Business As), or a completely separate business with a holding company as the overall controlling entity?

A holding company is a legal entity (usually a C Corporation or Limited Liability Company) that retains a controlling interest in one or more companies termed subsidiaries. Also known as a parent company or umbrella company, a holding company serves as asset protection and helps to limit liability risks among all the subsidiaries.

Increased Liability Protection

The biggest reason for creating a holding company is to limit liability risks among the subsidiary businesses in your corporate umbrella. The holding company actually owns each business’s assets, instead of each operating entity owning its own. Therefore, in case of legal or financial risk, the businesses and the owner are (mostly) protected from liability.

In addition, a holding company can also own:

- Stock and securities

- Intangible assets such as trademarks, patents, or copyrights

- Real estate

- Other businesses

The holding company serves as the administrator of the subsidiary entities but has no direct operations tied to it. Again, it owns the assets required to operate the LLCs beneath it.

Additional Advantages

In general, the activities of one subsidiary do not affect the activities of another subsidiary under the same parent company. Also, as long as the holding company has not actively participated in the operations of a subsidiary, the holding company cannot be held liable for that subsidiary. There are exceptions, of course. The exceptions are when the subsidiary and holding corporation have pierced the corporate veil, meaning has knowingly committed some sort of fraud or negligence.

Each subsidiary under the holding company is its own separate company, too. If you decide to form LLCs for each subsidiary, each one is responsible for registering with the state, filing separate Articles of Organization, having separate operating agreements, bank accounts, payroll, and filing separate tax documents. Fortunately, that also means you as the owner of the holding company can raise separate monies, attract investors, and create partnerships for each subsidiary, which may be far easier than attracting investors for a bigger corporation with many divisions.

Whether the holding company is an LLC or a C Corporation and owns more LLCs or C Corporations doesn’t matter except when it comes to filing taxes. If the LLC holding company owns a corporation, the LLC holding company must elect C Corporation tax status.

Setting Up a Holding Company

To benefit from the liability protection of a holding company, you’ll want to set up the holding company as a corporation or LLC.

Holding Companies as C Corporations

C Corporations offer personal liability protection for owners and shareholders because the corporation is a separate legal entity and all actions of the corporation belong to the corporation only. A corporation can also sell stock or shares and if you ever plan to go public, the business must be structured as a C Corporation. Because the corporation is a separate entity, the profits and losses of the corporation are reserved for the corporation. If owners or shareholders receive dividends, they are taxed on their shares.

The biggest complaint about becoming a C Corporation is the amount of paperwork, filing fees, and deadlines. C Corporations must adopt bylaws, hold annual director and shareholder meetings, and keep meeting minutes with corporate records.

However, many businesses form C Corps because liability protections are advantageous. Also, the Tax Cuts and Jobs Act reduced the corporate tax rate from 35% to 21%, which makes the C Corporation legal structure even more appealing.

Holding Companies as Limited Liability Companies

A Limited Liability Company also offers protection from personal liability and has less stringent requirements than C Corporations. Owners of the LLC are called members and can choose whether they want to be taxed as a Sole Proprietorship, Partnership, S Corporation, or C Corporation. In general, an LLC does not need to have an annual meeting or a board of directors, however, it should have an operating agreement, so members are clear on organizational structure. LLCs cannot issue stock to raise capital.

Your holding company should have an appointed board of directors to govern the holding company and manage the subsidiaries.

Note: A sole proprietorship is not eligible to be a holding company because it isn’t registered with a state.

CorpNet Can Help!

Once you’re ready to set up your holding company, it’s important to create a business plan and strategy to acquire or start new subsidiaries. Go over the plan with your attorney and financial advisor to work out any kinks.

When you’re ready to incorporate, contact CorpNet to help you with all your business registration filings! We can save you time and money when preparing and submitting your paperwork.

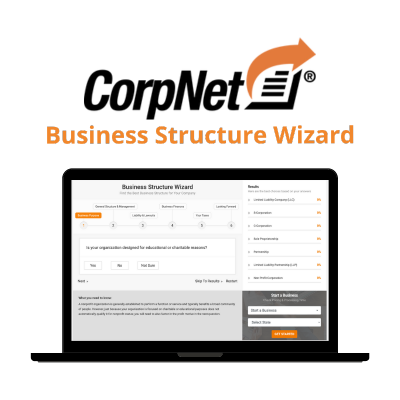

Choosing a business structure can be a tough decision for the new business owner. CorpNet wants to make the process easier.

This free, online tool helps small business owners navigate the process of picking the right business structure for their new business.