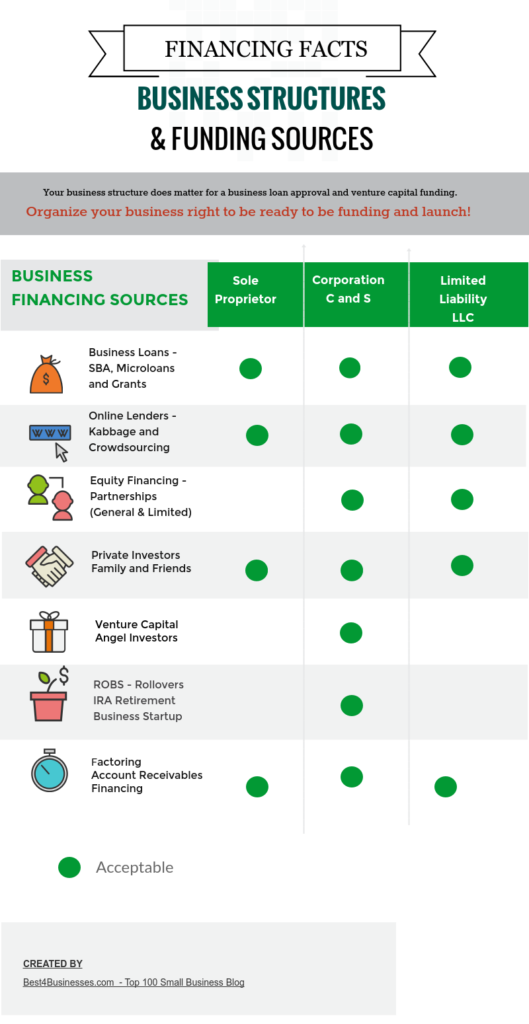

All the pieces of your entrepreneurial dream are finally falling into place. You have a name for your business, a product or service that makes you super excited, and you’ve even started noodling designs and logos. Before you can go much further, however, you’re going to need funding. And in order to get funding, you will need to decide what type of structure is best for your business: a sole proprietorship DBA (doing business as); a C corporation or S corporation; a professional limited liability company (PLLC) or a limited liability company (LLC).

Let’s take a look at the available types of small business funding, and for which entities they are most appropriate.

SBA Loans, Microloans, Grants

The U.S. Small Business Administration provides a variety of loans to businesses that fit the government’s definition of “small.” The most common loan program, the 7(a) loan program, stipulates certain other criteria: the business must also be for-profit, operate in the United States, and have reasonable invested equity; in addition, the proprietor must have already used personal financial resources before seeking SBA assistance.

The SBA’s microloan program is another option for qualified borrowers. Microloans, which must be administered through intermediary lenders, provide loans up to $50,000, although the average microloan is closer to $13,000.

While the Small Business Administration does not provide grants, some state and local programs, as well as non-profit organizations, do offer grants to small business owners. Usually, these grants require either a matching contribution or a concurrent loan; they are not necessarily “free money.”

These financing options are appropriate for all types of business structures. It doesn’t matter whether your company will be a sole proprietorship, a PLLC or LLC, or a corporation.

Crowdsourcing and Kabbage

The rise of online funding opportunities, like Kabbage, OnDeck, or crowdfunding sites, means that entrepreneurs have more options for funding than ever before. These may be good choices for sole proprietorships DBA (doing business as), since they represent a path to funding that doesn’t involve one’s personal savings.

Kabbage and OnDeck are both considered short-term business lenders — the terms range from one to 12 months for Kabbage and three to 36 months for OnDeck — but can be easier to secure than a bank loan. If you are starting a business that simply needs a quick infusion of capital, an online lender can be a good choice, but make sure you read up on the conditions. Kabbage, in particular, comes with a fairly high-interest rate.

Crowdfunding is another way to go. Sites like Indiegogo, RocketHub, peerbacker, and a whole host of other, niche-focused crowdfunding platforms make it easy to get the word out about your business as you raise capital. Of course, hitting up friends and family members to help get your venture off the ground is nothing new — but the proliferation of social networks (and the sharing they make possible) helps entrepreneurs cast an even wider net.

As with SBA loans, crowdfunding and online lending can be viable options for all business structures. They are also particularly useful ways to drum up some cash for a business that is already established, but that has faced financial hardship (such as a storefront fire, a theft, or another unexpected occurrence). Without the money, the business might not be able to keep running, but once it gets back on its feet, it will be able to funnel profits into paying off the short-term debt.

Equity Financing

This type of small business funding, which entails selling shares of the business to raise capital, comes with distinct advantages and disadvantages.

With equity funding, there’s no worry about personal credit issues, and no debt to repay. Furthermore, by establishing a partnership (either limited or general) — for which equity funding is the most common and popular type of financing, you will reap intangible rewards, too. Partners who are experts in your industry, or more experienced as business people, can serve as mentors and advisors, even if they are technically considered limited or silent partners (meaning that they bear no liability).

Some entrepreneurs may have to think long and hard before diving into a partnership – particularly a general partnership, in which they will share responsibilities and decision-making. Giving up full control over one’s business can be a difficult pill to swallow, and tensions can arise if the partners differ too widely in their management style or vision for the company.

Additionally, an equity funding or partnership arrangement means that when the profits start to roll in, you’ll be sharing the rewards as well as the responsibilities. Most small business owners are comfortable with the profit-sharing aspect of equity financing. They realize that without the initial investment and business acumen provided by the partners, they might not have made a profit — or as much of one — at all.

For obvious reasons, your company can’t be a sole proprietorship and a partnership. As a corporation, however, it is certainly feasible, not to mention desirable, to attract investors.

Angel Investors & Venture Capital

Some types of funding require that your company be incorporated, as either an S or a C corp. These are angel investors and venture capital investors.

Venture capital (VC) and angel investor financing options are usually only available to corporations. These savvy investors invest in your business in exchange for stocks in the firm. As with equity funding, one advantage of both angel financing and VC is that you won’t be expected to pay any money back, as you would with a loan. Instead, you are “paying back” the investors with shares.

It can be difficult to secure this kind of funding, however. Shows like Shark Tank may be giving would-be entrepreneurs the false notion that you can easily catch the eye of an angel investor or VC firm. While angel investors offer their contributions at the seed stage, they don’t tend to do so until the business owner herself has already pitched in her own capital. At that point, the investor may feel the risk is worth taking.

Venture capital firms tend to step in later, once seed funding has been established; they don’t tend to invest in startups, either, but rather in businesses that, while still too small to raise capital in public markets, are nevertheless poised to disrupt their industry and offer profitable payouts.

Choosing your legal business structure and getting business financing are two large aspects of starting a business. When you get these ducks in a row you will be well on your way to a successful new venture!