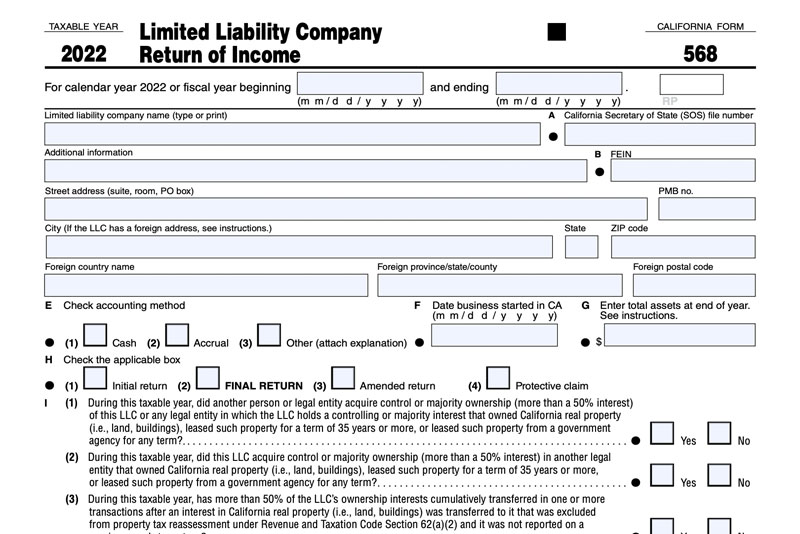

What is Form 568?

Most LLCs doing business in California must file Form CA Form 568 (Limited Liability Company Return of Income), Form FTB 3522 (LLC Tax Voucher), and pay an annual franchise tax of $800. These businesses are classified as a disregarded entity or Partnership.

Form 568 is a tax form that details your financial activity for the year. Activity that may be reported includes LLC income, property distributions, refunds, withholdings, and use tax.

LLC Tax Classification

One of the many benefits of electing the LLC business structure, in addition to the liability protections, simpler formation process, and flexible organizational requirements, are the tax classification options. By default, a single-member LLC that doesn’t elect to be treated as a corporation is considered a disregarded entity by the Internal Revenue Service (IRS) for federal and state tax purposes. These disregarded entities are taxed as Sole Proprietorships for single-member LLCs and as Partnerships for multiple-member LLCs.

However, LLC owners (called members) also have other tax treatment options. Members can opt for an LLC to be taxed as a corporation (with profits taxed at its corporate rate), or the LLC can choose an S Corp election, which allows the LLC to have pass-through taxation, but with the corporate benefit of a reduced self-employment tax burden. The S Corp election enables members to only pay Social Security and Medicare taxes on their income taken as salaries; members’ dividend income is not subject to self-employment taxes.

Again, only LLCs classified as disregarded entities (single-member LLCs) or partnerships (multiple-member LLCs) file Form 568 in California:

- LLCs filing as a corporation should use Form 100 (California Corporation Franchise or Income Tax Return)

- LLCs filing as an S Corp should use Form 100S (California S Corporation Franchise or Income Tax Return)

- General partnerships not registered as LLCs should use Form 565 (Partnership Return of Income)

All LLCs and S Corporations doing business in California must also pay the annual $800 franchise tax. Sole Proprietorships and General Partnerships are not subject to that tax.

Not sure what a franchise tax is? A franchise tax is a state tax levied on companies for the right to exist as a legal entity and to do business within a specific state. Franchise tax rates vary by state, are not dependent on a company’s profit, and are paid in addition to federal and state income taxes.

What is Considered Doing Business in California?

Generally, if an LLC has “done business in California” for at least one day of the year, it is subject to the California Franchise Tax. The California Franchise Tax Board considers you to be “doing business” if you meet any of the following:

- Engage in any transaction for financial gain within California

- Are organized or commercially domiciled in California

- Your California sales, property, or payroll exceed the thresholds listed on the Doing Business section of the California state website. However, even if you don’t meet the thresholds, you can still be considered doing business if you actively engage in a transaction in California for profit.

- LLCs are considered doing business in California if they have a general partner or member doing business on their behalf in California.

For remote sellers (LLCs formed in states other than California), the factors that constitute doing business is based on California’s threshold for nexus. Remote sellers have economic nexus if, in the preceding or current calendar year, the total combined sales of products and services into California exceed $500,000.

Form 568 Due Dates

- LLCs classified as partnerships use Form 568, due the 15th day of the 3rd month after the close of the company’s tax year. The annual $800 franchise fee is due on the 15th day of the 4th month after the beginning of the tax year.

- Single-member LLCs use Form 568, due the 15th day of the 3rd month after the close of the company’s tax year. The annual $800 franchise fee is due on the 15th day of the 4th month after the beginning of the tax year.

- LLCs classified as corporations use Form 100, due the 15th day of the 4th month after the close of the tax year. The minimum franchise tax is $800 and is also due the 15th day of the 4th month after the close of the tax year.

- LLCs classified as an S Corp use Form 100S, due the 15th day of the 3rd month after the close of the tax year. The minimum franchise tax is $800 and is also due the 15th day of the 3rd month after the close of the tax year.

First Year LLCs

Per the new rules established by the CA 2020 Budget Act (AB 85), for tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year. This exemption also applies to newly formed Limited Partnerships (LPs) and Limited Liability Partnerships (LLPs).

Also, if you cancel your LLC within one year of organizing, you can file Short form cancellation (SOS Form LLC-4/8) with the California Secretary of State, and your LLC will not be subject to the annual $800 tax for its first tax year.

Need Help Forming Your LLC in California?

CorpNet is here to help! Our business filing experts have in-depth knowledge of and experience with California’s registration and tax filing requirements.