The Launch Blog: Expert Advice from the CorpNet Team

Post-COVID Marketing Strategies for Accountants

Clients need their accountants more than ever in our post-COVID-19 world. Whether it’s getting ready for the extended tax deadline, figuring out how to utilize government relief funds or how to start a new business in a recession, accountants need to make sure...

How Smart Businesses are Pivoting to Find Success in the Midst of COVID-19

Business owners are constantly moving. Whether it’s tracking new trends, operating the shop, meeting with clients, or attending networking events, you’d think there can’t be one more thing to add to their plates. And then, COVID-19 hit. As business owners...

Marketing in the New Normal of COVID-19

Things are different today due to the global coronavirus pandemic. While we may eventually get back to some version of normal, when that happens is subject to much debate. COVID-19 changed how business gets done, from suppliers and distribution to sales and...

How To Safely Reopen Your Small Business to the Public

As the country makes plans to reopen restaurants, retail, public buildings, and schools, your topmost concern should be the safety and well-being of workers and customers alike. Your reopened business will be scrutinized and the measures you take to reopen safely...

Business Ideas for People Who Love the Outdoors

If you love the outdoors and have always wanted to start a business relating to your outdoor passion, now is a great time to take advantage of the country’s desire for outside activities. Here are some outdoor business ideas and trends you need to know to get you running on the right path to business success.

What Does It Mean to Have Multiple Trademark Owners?

One of the many risks business owners face is one that rarely comes to mind—but could put your business in a dangerous position. We’re talking about trademark protection for your intellectual property. A trademark is a word, phrase, name, or symbol that identifies...

Outsourcing to Get Back to Business

Making plans to get your business back on track post-coronavirus pandemic? Here are five responsibilities you should consider outsourcing so you can devote more of your time and energy to the areas where you are most needed. 1. Website Updates and Maintenance Your...

10 Mistakes to Avoid When It Comes to the CARES Act Funding Relief

With tons of misinformation swirling out there, you may be afraid of making a crucial mistake when it comes to applying for and receiving CARES Act relief funding. Here are 10 mistakes to avoid. Application Mistakes 1. Not Being Prepared Any delay in your...

The Small Business Mid-Year Checklist

How are we nearing mid-year already? If you’re like me, the current business climate has been a whirlwind of trying to keep up on new information, planning for post COVID-19 recovery, and still maintaining running our business operations. Now that we’re approaching...

9 Tax Benefits in the CARES Act

There are more advantages to the CARES Act than just relief funding that can help your small business save money and those come in the form of tax breaks. Although most of the breaks are temporary, it’s important to take advantage of all that’s being offered to...

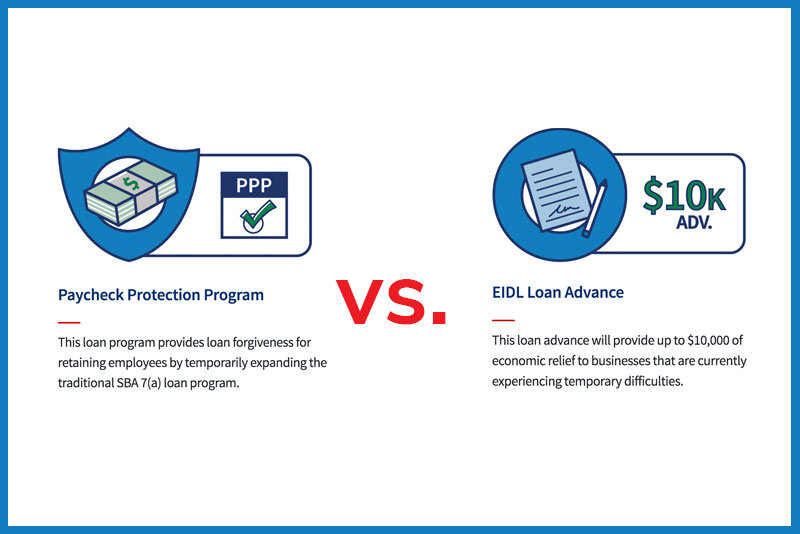

How Loan Forgiveness Works for the PPP and the EIDL Loan Programs

Now that we are in full swing of the coronavirus pandemic, small businesses across the country are trying to make sense of the CARES Act and how the relief funding can help keep their businesses afloat. One area of confusion seems to be how a business receiving...

COVID-19 Relief Funding Alternatives

As of April 16, 2020, the SBA announced all appropriations for the Paycheck Protection Program and the Economic Injury Disaster Loan were exhausted. Small business owners are now in need of COVID-19 relief funding alternatives. Below is a list of some COVID-19...

Paycheck Protection Program for the Self-Employed and Sole Proprietors

By now we have all at least heard about the Economic Injury Disaster Loan and the Paycheck Protection Program enough to know what the acronyms EIDL and the PPP stand for. Even the infamous Pandemic Unemployment Program aka the PUA has become part of our daily...

What Government Loan Program Should You Apply For?

Can’t decide whether you should apply for the Paycheck Protection Program (PPP) loan from the SBA or the Economic Injury Disaster Loan (EIDL) from the U.S. Treasury? Truth be told, many of your fellow small business owners have already turned in their applications...

Adapting Your Business to Remote Activities and Shifting Business Hours

Who would have imagined we would be in the situation we’re facing today? The coronavirus pandemic has turned our world upside down and created an entirely new definition of “business as usual.” Many entrepreneurs, including me, have had to shift their business...

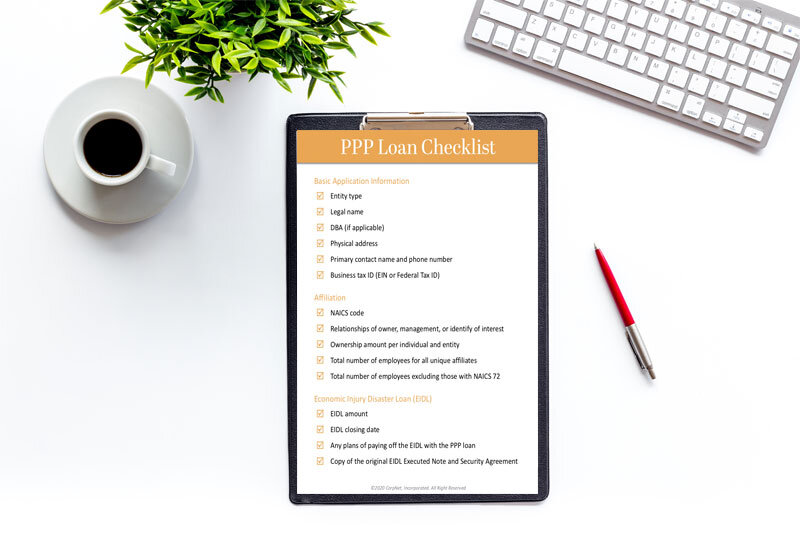

Paycheck Protection Program Loan Checklist

The SBA’s Paycheck Protection Program is an amazing opportunity for small businesses. It provides a 100% forgivable loan to cover payroll, rent, and utilities. The United States government has moved swiftly to get this program funded and operational. And in some...

Don’t Lock Your Credit if You’re Applying for a CARES Act Loan

I'd like to do a very quick public service announcement to alert you of something that can turn into a pretty big mistake. Things are moving so quickly with the CARES Act and Coronavirus relief that I almost didn't catch it myself. If you've locked your credit...

How to Calculate Your Payroll Protection Program Loan Amount

To help small businesses keep their business going and their staff employed, the federal government passed the CARES Act, which is administered by the Small Business Administration (SBA). One of the most useful parts of the CARES Act is the Paycheck Protection...

Florida Annual Report Deadline Extended Due to Coronavirus

Normally, at this time of year, you might find yourself scrambling to file your Florida annual report by the May 1st deadline. A business’s annual report confirms or updates a company’s information in the Florida Division of Corporations' records. The State...

Coronavirus Relief & Aid for Small Businesses

During this uncertain time, I know many small business owners and entrepreneurs are feeling overwhelmed and stressed by the unknown. Not only do entrepreneurs worry about how the COVID-19 situation will hurt their businesses, but they also feel concerned about...

What Employers Need to Know About Sick Leave During the Coronavirus Crisis

Employers across the nation are feeling the pressure to keep their businesses up and running and profitable during the current COVID-19 pandemic. Whether you’re concerned about hunting down alternate suppliers or keeping employees and customers safe from...

What California’s AB 5 Means for the Gig Economy

In 2020, the hot topic is California’s Assembly Bill 5, often called the “Gig Economy Bill.” This is because AB 5 makes it difficult to be an independent contractor in California. Before we examine AB 5 in detail, let’s understand why California legislators passed...

Remaining Independent Under California’s New AB5 Law

Whether you work as an independent contractor or your business hires independent contractors, California’s new AB5 law, which went into effect January 1, 2020, forces your hand on becoming an employer or an employee depending on how you conduct your business. The...

LLC-5 and the California Foreign Limited Liability Company

What is an LLC-5? The LLC-5 is a California State form used when a domestic limited liability company formed in another state (or country) wishes to become a foreign limited liability company in California. The official name of Form LLC-5 is “Application to...

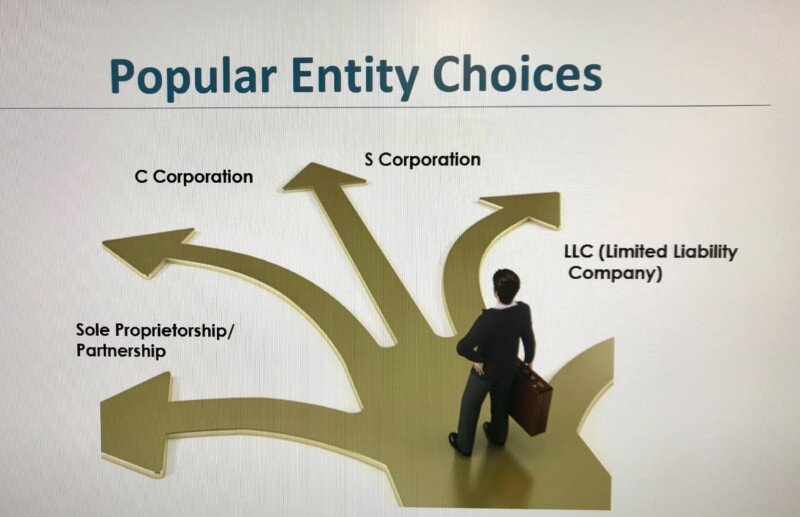

Advising Clients About Business Structures

With all the decisions your clients are expected to make when starting a business, which legal structure to choose might not get as much consideration as it should. Most business owners choose to form a sole proprietorship in the beginning, since it’s less...

Webinars About How to Choose the Right Business Entity

Wondering how to choose the right business entity? Consider watching these webinars to learn about the pros and cons of various business structures.

What Entrepreneurs Should Know About Calculating Sales Tax for Business

Confused about how to calculate sales tax for business? Learn about recent sales tax legislation, tools for calculating sales tax, and more.

Increase Professional Services Revenue with the CorpNet Partner Program

A path for business coaches, CPAs, lawyers, tax advisors, and bookkeepers to increase professional services revenue without overworking or adding overhead.

Three Tips for Business Coaches to Help Their Clients Succeed in 2019

How can you help your coaching clients achieve entrepreneurial success? These tips for business coaches will help you help your clients succeed.

The CorpNet Partner Program Opens a New Revenue Stream for Your Business— Without Adding Overhead

The CorpNet Partner Program gives professional services providers a way to increase revenue without adding overhead. Here’s how it works.