The Launch Blog: Expert Advice from the CorpNet Team

How to Choose and Legally Use Your Business Name

The name you choose for your business will be one of your most powerful and valuable assets. As one of the primary ways customers distinguish you from your competitors, your business name wields a lot of power. The right name can help propel you to success; the...

LLC vs. Partnership

When deciding between an LLC vs. partnership as your company's business structure, you'll have many considerations to address. There are ramifications legally, administratively, and financially when choosing a business entity type. Rushing to a decision can have...

What is a Certificate of Incorporation?

When forming a C Corporation, business owners need to file for a Certificate of Incorporation (sometimes referred to as Articles of Incorporation) to register their company with the state. What is a Certificate of Incorporation exactly? It is a legal document...

S Corporation vs. LLC

Limited liability companies (LLCs) and S Corporations are business structures that provide liability protection for business owners and allow for pass-through tax treatment. While they have those things (and some others) in common, they differ in several ways, too....

How to Add a DBA to an LLC

Some companies, such as Limited Liability Companies (LLC), choose to do business under a different name than the one they have registered in their formation documents. Like other businesses, before an LLC may use an alternate name in its contracts, advertising, and...

Setting Up Payroll for an LLC or Corporation

Payroll involves far more than just cutting a paycheck to employees. It entails calculating work hours, wages, salaries, benefits, wage garnishments, and withholding and paying employment-related taxes. So, what do business owners need to know about setting up...

Incorporating a Business 101

As a business owner, the day will come when you inevitably will have to address the legal aspects of your business – and the sooner the better. And, fortunately, the process can be relatively painless and hassle-free. I talk to countless small business owners and freelancers who consider themselves too small to worry about incorporation. After all, you don't have mazes of cubicles…you may not even have any employees. However, incorporation can still be a smart idea even for the self-employed graphic designer or wedding planner and in this post we discuss the benefits of incorporating your small business.

Checklist for a Home-Based Business

Many entrepreneurs start their small businesses in their homes. Without the costs associated with renting or buying office space, it helps keep startup expenses down. Still, business owners running their companies out of their houses must pay attention to many...

How to Change from a Sole Proprietor to an LLC

It's estimated that over 70% of U.S. businesses operate as sole proprietors. That's not surprising, considering that doing so requires no formal business registration forms, few compliance requirements, and income tax reporting simplicity. But as businesses grow...

7 Tips to Help Your Business Survive Through a Recession

Is there a recession on the way? The best and most honest answer is maybe. Some economic signs point to a coming economic downturn, while others, like the nation operating at nearly full employment, suggest otherwise. It may be a cliché, but only time will tell. In...

How to Start a Business With a Partner

You’ve heard the phrase "two heads are better than one” and that often rings true for entrepreneurs. Along with the pooled knowledge from multiple brains, having a business partner brings the perks of additional funds, a wider breadth of skills, a built-in support...

C Corporation vs. S Corporation

If you have your sights set on incorporating your business, you may be wondering if a C Corporation or S Corporation is the better option. While both are popular choices, nuances exist that may make one or the other more advantageous for your situation. The...

What is Payroll Processing and What Do You Need to Know About It?

Payroll processing has a lot of moving parts. Read this post to find out what it involves and how CorpNet can help your business satisfy the requirements.

What is Payroll?

Payroll refers to the various tasks and responsibilities businesses must perform to pay their employees accurately and on time. It encompasses calculating wages and salaries; preparing checks or paying employees via direct deposit; withholding taxes and other...

How to Start a Tax Preparation Business From Home

Do you already have experience in preparing tax returns as an employee or temp for a tax agency and wish you had more control over your schedule? Or are you looking to capitalize on your math abilities and attention to detail on your own terms? Either way, you may...

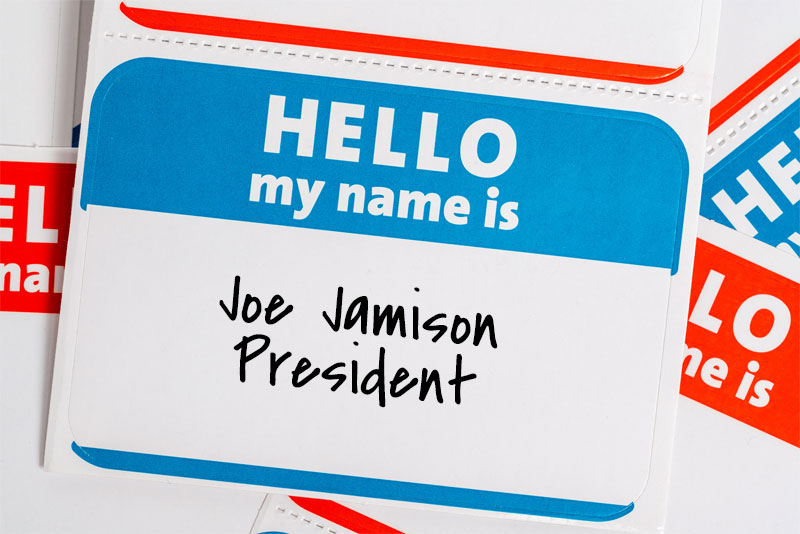

What is the Owner of an LLC Called?

The Limited Liability Company (LLC) business structure is a popular choice for entrepreneurs in nearly all industries because of its simplicity, personal liability protection, and tax and management flexibility. An owner of an LLC is called a member, and an LLC may...

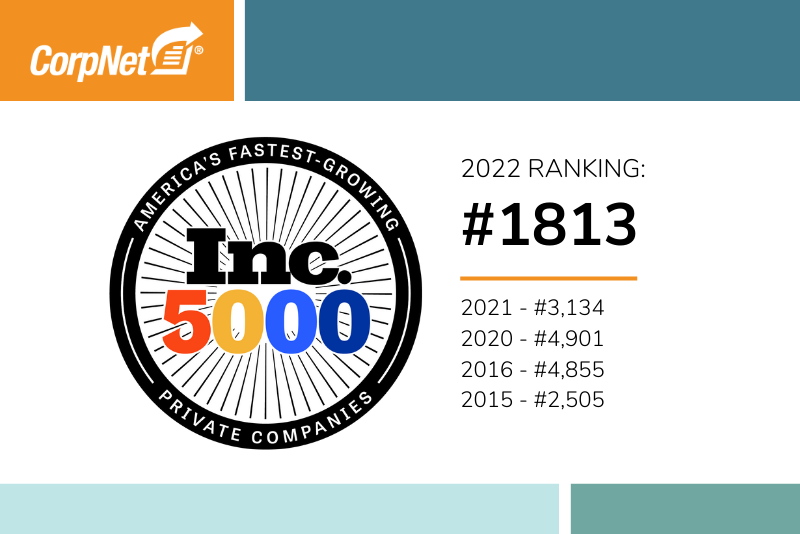

CorpNet Awarded Inc. 5000 for 2022

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. 5000 list in 2022 as one of the fastest-growing private companies in the country. This is the fifth year CorpNet has been honored and 2022 is the highest ranking to date. CorpNet's Inc. profile...

What Is a Trademark?

Now that you’ve started your business, it’s time to protect its name. After all, your business name is — and will continue to be — one of the most crucial branding assets you possess. So, how do entrepreneurs protect that critical element from being infringed upon...

A State-by-State Guide to Economic Nexus

Economic Nexus The Supreme Court ruling on the South Dakota v. Wayfair case in 2018 changed how out-of-state retailers collect and remit sales taxes in each state. At a minimum, states can mandate that businesses without a physical presence in a state and with more...

How Do You Pay Yourself as a Sole Proprietor?

Many small business owners start their companies as Sole Proprietorships. The Sole Proprietorship business structure offers setup simplicity, cost-effectiveness, and minimal business compliance requirements. As with any form of business, entrepreneurs must consider...

What are Articles of Incorporation?

If you’ve decided to establish your business as a corporation, you’ll need to fulfill your state’s requirements for registering your company. Among those requirements is filing an Articles of Incorporation (sometimes called Certificate of Incorporation) with the...

Choosing the Best Business Structure for Your Industry

Entrepreneurs face many critical decisions as they launch their businesses. Among the most important is selecting the best business structure for their company. Because of the legal, financial, administrative, and operational implications of the entity chosen,...

Sole Proprietorship vs. LLC

Are you considering starting a business as a solo owner, or will you co-own the business with your spouse? Then, you may be wondering if operating as a sole proprietorship or a limited liability company (LLC) will be the better choice. What are the advantages and...

What Is a Reseller License?

If you’re starting a retail business (whether online or at a brick and mortar location), you’ll want to apply for a reseller license. A reseller license certifies you don’t have to pay sales tax when buying products on a wholesale basis for the purpose of reselling...

How to Move A Business To Another State

When you move from one house to another, you likely have a checklist of things you need to take care of in the process from changing your mailing address and calling your cable TV provider and your internet company. But when moving your business to another state,...

Setting Up LLC Partnership Agreements

The Limited Liability Company (LLC) business structure is one of the most flexible and simple business entity types that entrepreneurs may choose. LLCs aren't usually required by states to have an LLC partnership agreement; however, it's something to...

How Much Does It Cost to Start a Business?

Preparation matters when launching a business. And knowing your startup and ongoing costs is among the most important steps of the process. It’s critical for seeking funding, attracting investors, and estimating when you’ll break even and begin turning a profit....

Stats, Tips, and Steps for Starting a Freelancing Business

If you have marketable skills and knowledge as a self-employed independent contractor, you may wonder if you should freelance, and if so, how you'd go about starting a freelance business. And with the current economic climate of the great resignation and possible...

How to Prepare Your Small Business for a Recession

Is a recession on the way? While some economic experts believe a recession is on the way, others, such as the National Retail Federation (NRF), think that although the economy is slowing, consumers are financially healthy and a recession is unlikely in 2022. And...

Can You Have Multiple Businesses Under One LLC?

There may come a time when you decide to expand your business into an additional area of focus or take an online business to a storefront (or vice versa). These shifting operations lead business owners to wonder if they can have multiple businesses under one LLC....