The Launch Blog: Expert Advice from the CorpNet Team

The Startup Business Plan: Why It’s Important and How You Can Create One

I think it’s safe to say that nearly all business experts agree that all entrepreneurs can benefit from having a business plan. Why is a business plan important for your startup? According to a study by Palo Alto Software, entrepreneurs who have a business plan...

How Do LLC Owners Get Paid?

As a small business owner, how you pay yourself depends on your business’s legal structure and how you elect to pay taxes. The Limited Liability Company (LLC) is a popular legal entity offering liability protection to its owners (called members), simple compliance...

Do You Need an LLC for Rental Property in Another State?

No matter where you’re buying a rental property, protecting that investment is important. Many real estate investors who own rentals choose to set up each of their properties as a Limited Liability Company (LLC). Doing so helps protect their personal assets from...

10 Strategies for Growing a Business

Uncertainty is not unfamiliar territory for business owners. However, these past few years have brought a significant amount of ups and downs to entrepreneurs everywhere and in nearly all industries. While some companies focused on their short-term goals, other...

10 Ways to Create a Successful Brand for Your Small Business

One of the key steps to starting a new company is creating a strong brand. Do it right, and you’ll have a memorable brand that customers line up to do business with. If you are a new business owner, you might not know where to even start. I've been there and I...

Time to Declare Your Independence

For many, the American dream is all about entrepreneurship. Business ownership is a way to declare personal independence and even though the economy has been a roller coaster lately, it hasn’t quieted America’s entrepreneurial spirit. As a matter of fact, despite...

How to Legally Start a Marijuana Business in California

With the legalization of marijuana for adult recreational use in California, it’s an exciting time for the state’s business community. The law brings many opportunities for entrepreneurs interested in producing and selling cannabis and cannabis products. CorpNet is...

LLC’s: Best Biz Structure to House Multiple Properties

With any property, there are inherent liabilities — from a broken balcony railing to old electrical wiring or mold. The LLC forms a wall that shields individual owners from personal liability. If sued by a tenant or guest, the defendant is the LLC, not you. And the judgment can be collected only from the LLC's assets, and not from your own personal assets.

10 Ways to Take Care of Your Kids and Your Business This Summer

School’s out! Chances are your kids are celebrating right now because weeks of summer vacation beckon. But, if you’re starting a business or running a business, and you have school-aged children, you’re likely feeling a little conflicted. Entrepreneurs like me, and...

Virtual Companies and Nexus: What Small Businesses Need to Know

Over the last two years, many businesses have chosen to go virtual, either temporarily or on a permanent basis. But that decision can impact the business’s nexus status. Companies with remote employees in other states may also need to register for foreign...

Does Being an LLC or Corporation Help Build Business Credit?

Establishing healthy business credit is essential to ensure a company can thrive and grow. If an entrepreneur doesn’t take measures to establish credit in their business name, they may miss out on opportunities and even pay more than they have to for goods and...

LLC vs. PLLC: Which Structure is Right for Your Business?

Choosing the appropriate business structure for your company is complicated. For attorneys, physicians, accountants, architects, and some other licensed professionals, there are extra factors to consider. Professionals who want liability protection and flexibility...

What is the Role of an Incorporator?

Starting a new C Corporation can be complicated and entails several legal, administrative, and administrative steps. Whether you’re starting the business on your own, with a partner, as part of a team, or converting your current business structure to a corporation,...

Michigan Annual Report Filing for LLCs and Corporations

The state of Michigan requires all business owners of limited liability companies (LLC) and corporations to file an annual report. An annual report is a filing that helps ensure the state's records about a business entity are accurate. Michigan has specific due...

Does a Real Estate Agent Need an LLC?

Real estate agents, just like other self-employed professionals and independent contractors, should consider how to safeguard their personal assets from business-related liabilities. As a real estate agent, you may wonder if you need an LLC to get that level of...

Understanding the Various Types of Nonprofits

What Is a Nonprofit? A nonprofit organization is created to fulfill a charitable, civic, religious, scientific, literary, or educational goal. Nonprofits do not have private owners, nor do they issue stock or pay dividends to shareholders. Aside from founders or...

Basic Tips for Building Business Credit

A business entity can have its own business credit record and score. Lenders, suppliers, vendors, and even potential customers might check a company’s credit score (which is publicly available) before providing funding or doing business with the company. Business...

Trademarks vs. Copyrights vs. Patents

From your company logo to your trade secrets, your business’s intellectual property has value. That’s why it’s important to take measures to protect it. What are the various types of intellectual property and how can business owners’ safeguard them? Here’s a...

How to Protect Your Brand with Trademarks

If you’ve incorporated your business or formed a limited liability company, you’ve taken critical first steps toward building a successful business. When registering your business, you’ve protected your company name from being used by competitors in the state the...

What is the Role of an LLC Organizer?

Starting a new Limited Liability Company (LLC) can be complex, entailing several legal, administrative, and organizational steps. Whether you’re starting the business on your own, with a partner, as part of a team, or converting your current business structure to...

How to Apply for an EIN if You’re Not a United States Citizen

An EIN (Employer Identification Number), also known as Federal Tax ID Number, is a 9-digit number issued by the IRS that the United States federal government uses to identify a business for tax purposes. Every business with employees or registered in the U.S. as a...

How to Get Certified as a Women or Minority-Owned Small Business

Small business certification comes in many forms and offers incredible opportunities for business owners to work with and compete with larger businesses for contracts. Federal government agencies and many state and local governments must set aside a percentage of...

Meet the People Behind CorpNet’s Success

We are immensely grateful for our team members’ talents and contributions. They have fueled our growth and remain the key to our continued success in helping aspiring and existing business owners make their entrepreneurial dreams come true. What do our employees...

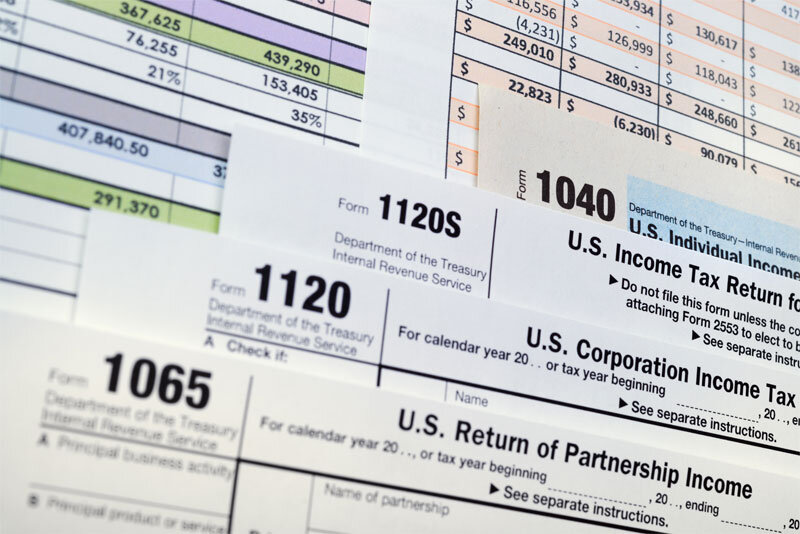

What Business Owners Need to Know About Filing Taxes in 2022

Tax season is right around the corner. A lot has changed, tax-wise, in the past year due to new legislation. Here’s a quick look at what business owners need to know about filing their taxes in 2022. Sole Proprietorship Sole proprietors are unincorporated...

Do I Need a New EIN?

If you already have an employer identification number (EIN) for your business but have recently made some changes, you may be wondering, “Do I need a new EIN?” Depending on the type of business entity and the circumstances, the IRS may require you to apply for a...

Meet CorpNet’s Inspiring Senior Account Manager: Amanda Beren

CorpNet’s high-caliber team members, who bring their diverse strengths and talents to work with them every day, fuel our company’s success. No one exemplifies hard work and dedication more than our Senior Account Manager, Amanda Beren. We’ve recently featured...

Registered Business Name vs. Trademark

One of the first decisions new entrepreneurs make is “What should I name my business?” A lot of brand equity gets built around a business name, so it’s essential to protect that valuable marketing asset. During a presentation to accounting professionals, I...

Meet the Go-To Person at CorpNet: Milton Turcios, Director of Operations

Every individual at CorpNet brings unique skills and qualities that make them an integral part of our team. This could not be truer of our Director of Operations, Milton Turcios! We’ve recently featured Milton in a video in our series that highlights various...

Expanding a Small Business to Another State: What You Need to Know

Extending your small business’s presence across state lines can help your company reach new markets, grow revenue, and boost profits. But how do you expand a small business into another state? And what’s involved in operating a business in multiple states? There...

Meet the Driver and Doer Behind CorpNet: Nellie Akalp, Founder and CEO

Every person on the CorpNet team has contributed to our continued success. Our recently created series of videos features several of our team members to give you a glimpse of “who’s who” and their take on what they do and why they do it. In this post, we’re...