The Launch Blog: Expert Advice from the CorpNet Team

Help Clients Choose What Is the Best Business Structure Without Fear of Unauthorized Practice of Law

What is the best business structure? Here's how to help your clients (and boost your revenue) without illegally engaging in the practice of law.

The Consequences of Noncompliance in Business

Business compliance is a phrase that makes many an entrepreneur cringe. But despite the lack of affection for those two words, business owners must take them seriously. The possible consequences for noncompliance range from mild inconvenience to devastating...

Do LLC Owners Pay Self-Employment Tax?

Many small business owners choose to operate their companies under the LLC business structure. They do so with good reason! The LLC offers liability protection to its owners (members), tax flexibility, and compliance simplicity. However, that tax flexibility may...

The Bookkeeper’s Guide to Outsourcing

How many of your bookkeeping clients are business owners outsourcing their accounting tasks to you? If you’re lucky, probably quite a few, since small and large businesses alike have plenty of complicated financial needs. Smart business owners know that outsourcing...

How to Start a Business as a Kid or Teen

Starting a business as a kid or teen is exciting! With it, comes an opportunity to learn life-long skills that will help you become a successful adult. And, of course, there's the money you can earn! But how do you start a business as a kid or teen? Well,...

How to Start a Virtual Bookkeeping Business

Wondering how to start a virtual bookkeeping business? This article shares what aspiring self-employed bookkeepers need to think about.

How to Legally Start an eCommerce Business

If you have been considering starting an eCommerce business, you’re exploring an industry with a promising outlook. The last few years have forced many people to buy products online and this new way of shopping isn't going away anytime soon. In today's article,...

Does Your Business Need a DBA?

In the course of running your business, you’ve probably encountered more legal fine print and formalities than you ever thought possible. In this post, we’ll break down the Doing Business As (DBA) to see if your business needs one.

What Is an Anonymous LLC?

While it may sound mysterious and intriguing, an anonymous LLC (also called a private or confidential LLC) is just like a regular Limited Liability Company, except its members and managers are not publicly identified. The names, addresses, and contact information...

16 Considerations When Choosing a Business Filings and Compliance Provider

Entrepreneurs cannot succeed in business completely on their own. Successful business owners will leverage their talent, expertise, and skills, while also being quick to delegate tasks and responsibilities to others with the knowledge and proficiencies they lack....

What Is a Pass-Through Entity?

A pass-through entity refers to a business that does not pay income tax of its own. Its income, losses, credits, and deductions “pass-through” to each business owner’s personal tax return, where its profits are taxed according to each owner’s individual income tax...

Can You Have Multiple EIN Numbers?

Just as a Social Security Number identifies an individual taxpayer, an Employer Identification Number (also known as an EIN, Federal Tax ID Number, or FTIN) is a nine-digit number that identifies a business entity. In addition to the IRS and other tax authorities...

How to Start a Business in the United States as a Foreigner

The United States of America holds 13.5% of the global GDP and is only second to China in its share of global revenue. This statistic, along with its strong economy, makes the United States an ideal location for foreigners to start a business and capture that...

What Happens If You Accidentally Miss a Tax Deadline?

In this article, I’ll discuss the potential consequences for professional tax services providers and their clients (taxpayers) when tasks get forgotten and tax deadlines have been missed. I’ll also touch on options for resolving late filing and payment issues with government agencies.

How to Avoid Double Taxation as an LLC or S Corporation

There are a whole host of reasons to incorporate as a C Corporation. For example, the C Corporation is the preferred structure if you intend on seeking VC funding or taking the company public. But forming a C Corporation involves more paperwork, legal fine print,...

A State-by-State Guide to Seller’s Permits

If your business plans to sell products or services, most states will require you to obtain a seller’s permit. This seller's permit can also be called a sales tax license or sales and use tax permit. The process and fees for obtaining a seller’s permit vary by...

How the Corporate Transparency Act Affects Your Company

Per the recently passed Corporate Transparency Act (CTA), owners of smaller Limited Liability Companies (LLCs) and corporations will soon have another compliance requirement to adhere to starting on January 1, 2024. LLCs and corporations with fewer than 20...

What Is a Fictitious Name?

What Is a fictitious name? A fictitious name is a name other than your proper legal business entity name that you formally get permission from the state (or county) to use when conducting business. You may also see a fictitious business name referred to as: Doing...

What Is a Letter of Good Standing?

Professionals like you, who help entrepreneurs navigate the challenges of starting and growing their businesses, will likely encounter clients asking about a "Letter of Good Standing." Let's take a moment to talk about what a Letter of Good Standing is and why...

How to Start a Consulting Business

If you have a high level of proficiency, expertise, and experience in a field, you may have thought about how to start a consulting business. Starting a consulting business can be a wonderful career option for individuals who want to leverage their knowledge and...

How to Legally Dissolve a Corporation or LLC

Dissolution is the act of formally dissolving (closing) a business entity with the state. It involves far more than just stopping to sell products and services. Dissolution is a process for wrapping up all legal and financial aspects of the business and legally...

4 Real Reasons Why You Need a Dedicated Business Bank Account

Many entrepreneurs have a difficult time managing their finances. Starting your business off right is important, and keeping your finances in check from the beginning will help create a foundation for long-term success. Part of this strategy is creating and...

How to Start an Accounting Business

Whether you’re a finance major fresh out of college or have been working in an accounting firm or department for years, I’ll bet you’ve thought about being your own boss. There’s a lot to consider when exploring how to start an accounting business. Let's dig into...

Can an S Corporation Use LLC or Inc in Its Business Name?

If you are considering electing S Corporation status you might wonder how this will impact your existing LLC or C Corporation. One question that comes to mind quickly is the continued ability to use LLC or Inc with a business name. S Corporation election is a tax...

Can a Single-Member LLC Be an S Corporation?

A single-member LLC can be taxed as an S Corporation if it meets the IRS’s eligibility criteria. In fact, both single-member and multi-member Limited Liability Companies can elect to be treated by the IRS as either an S Corporation or a C Corporation if they meet...

The Difference Between a Business Entity Statutory Conversion and Business Domestication

Statutory conversion vs. business domestication. One changes a business entity type; the other changes a company's home state. Read on to learn more!

How to Legally Change a Business’s Name

Despite your best efforts to choose the perfect name for your company, there may come a time when that name no longer is the best fit. Perhaps the business name no longer accurately reflects your brand or there are legal considerations at play. Regardless of the...

Who Are the Officers of a Corporation?

A corporation has three main categories of stakeholders involved in the financial and management aspects of the company. While all play a crucial role, officers work more closely with a corporation’s managers and supervisors, arguably having a more direct impact on...

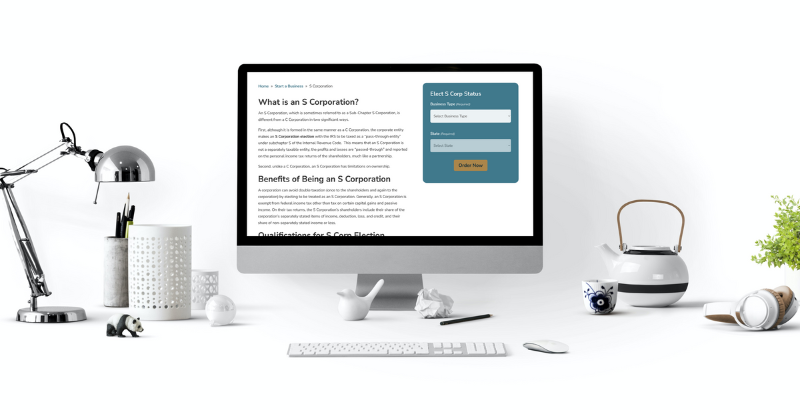

The S Corp Election Deadline is Right Around the Corner

The S Corporation election deadline for LLCs and C Corporations is March 15, 2023. So, if you’re considering changing your limited liability company or C Corporation tax treatment from its default status to an S Corp, time is of the essence! About the 2023 S Corp...

Do You Need Annual Meeting Minutes for Corporations and LLCs?

What business owners should know about annual meeting minutes for corporations. What are they, who must have them, and how do you create them?