The Launch Blog: Expert Advice from the CorpNet Team

What is an LLC Statement of Information?

No matter which state your Limited Liability Company (LLC) is located in, you will need to file documentation with the Secretary of State to establish your company and keep it legally compliant. A Statement of Information is one of the standard reporting...

How to Apply for an EIN

One of the essential steps new business owners must take when launching their companies is to apply for an EIN. An Employee Identification Number (also known as a Federal Tax ID Number or Tax ID Number) is a nine-digit number assigned to a business for filing...

Do Amazon Sellers Need an LLC?

Amazon sellers, like other entrepreneurs that sell products online, should think about how their business structure affects them professionally and personally. The business entity type chosen has an impact on income tax obligations, ongoing business compliance...

Can an S Corporation Own an LLC?

When entrepreneurs want to expand their businesses, they face the important decision of how to structure that growth. One approach is to form a separate company under another registered business entity. Some restrictions exist and small business owners may be...

Buying a Business Checklist

Want to buy an existing business? You’re not alone. BizBuySell.com, a marketplace for business buyers and sellers, reports continued strong business-for-sale activity in the second quarter of 2018. Small businesses sold for a median sale price of $239,000 in the...

Choosing the Best State to Start a Business

Choosing the best state to start a business is an important detail in your overall business plan. When it comes to launching a small business, “Location, location, location” is part of the formula for success. If you’re wondering if a specific location would give...

Business Name Restrictions: What to Know Before Registering Your Business

One of the most exciting initial tasks to tackle when starting a business is brainstorming names for your company. It’s also one of the most critical to-dos; your company’s name will be the foundation of your brand, so you need to consider it carefully. As you...

How to Budget as a Freelancer

Creating a budget as a freelancer shouldn’t be any harder than it is for any other small business. And yet, the rollercoaster ride of finding and keeping clients, collecting invoices, marketing your business, and juggling all of this yourself can create major...

The Best CPA Marketing Channels for Growing Your Firm

Whether your accounting business is just starting out, or whether you’re a seasoned veteran, marketing your business is a must. It’s crucial in good economic times and in bad. In fact, during an economic downturn, choosing the right CPA marketing channels for your...

What Is 501(c)(3) Status and How Do You Obtain It?

Have you always dreamed of starting a nonprofit organization so you can give back to your community? Maybe you have a charity that’s close to your heart, such as research for autism or helping the homeless, and you’ve always wanted to have the same kind of impact...

Is a Farm LLC Really Necessary?

Starting and running a farming business provides the opportunity and the freedom to forge your own professional path. There’s hard work involved and any seasoned farmer will tell you farming is a 24/7 commitment. And an agricultural business comes with many of the...

Do I Need Articles of Organization For a Michigan LLC?

If you're considering forming a Limited Liability Company (LLC) in Michigan, you're probably wondering what paperwork the state requires. For example, do you need Articles of Organization for a Michigan LLC? That's one of the common questions we field here at...

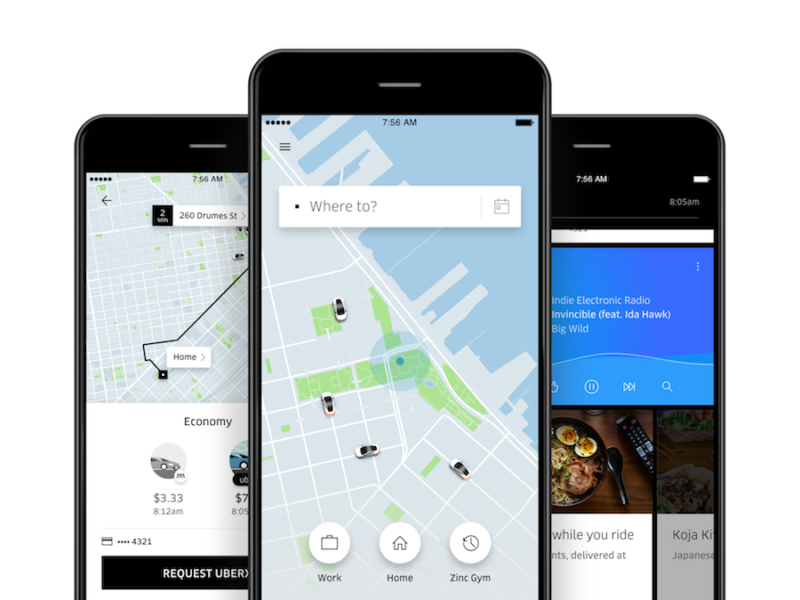

Do Uber Drivers Need an LLC?

Uber drivers, even those doing rideshare driving as a side gig, are considered to be earning income through self-employment. Just like other self-employed independent contractors, they face some critical startup decisions—including what business entity type to...

How to Find Your First 10 Accounting Clients

Searching for the first clients for your startup accounting business might seem like finding a needle in a haystack (or, for you Harry Potter fans, like finding a Horcrux in the Room of Requirement). In reality, however, it can actually be pretty simple, thanks to...

Can a Sole Proprietor Have Employees?

Even when a small business starts as a sole proprietorship with only a solitary business owner who handles everything, growth and expansion are often the ultimate objectives. To achieve those goals, a sole proprietor will likely need some help along the way — which...

Ten Tips for Creating a Business Name

Creating a business name is one of the most exciting and important startup tasks that entrepreneurs must tackle. The name you choose for your business will serve to distinguish you from your competitors and give customers insight into the experience they will have...

Seven Tips for Optimizing LinkedIn for Accountants

With more than 849 million users, LinkedIn is a powerhouse of social media. While it doesn't command the 2.9 billion users of Facebook, it is the top location for connecting at a business-to-business level. The social network has established a solid niche for...

DBA vs. LLC: What’s the Difference?

If you’re starting a new business or adding new locations or business lines to an existing one, you are likely wondering if registering a DBA (doing business as) or forming an LLC (limited liability company) is the best route to travel. A DBA is an assumed...

Dissolutions and Moving Your Business to a New State

If you’re planning to move your business to another state or close it altogether, there’s a process you must follow, which varies by the structure of the business. It may seem a bit complex, but we’ll simplify it for you. Feel like it’s too late to close your...

What Are Payroll Deductions?

Payroll deductions are monies that employers withhold from an employee’s pay. These deductions include withdrawals such as federal income taxes, state income taxes, local income taxes, FICA tax (Social Security and Medicare taxes), medical benefits, retirement...

LLC vs. S Corp vs. C Corp

Yes, operating a business as a sole proprietor or general partnership offers simplicity, but that comes at the cost of not having a separation between you as an individual and your company. Are there other options? There are alternate options that include popular...

How to Register a Business in Oregon

Have you been thinking about making your dream of starting your own business in the beautiful Pacific Northwest a reality but not sure how to begin? This post will help guide you through the process of registering a business in Oregon. That said, let’s get started...

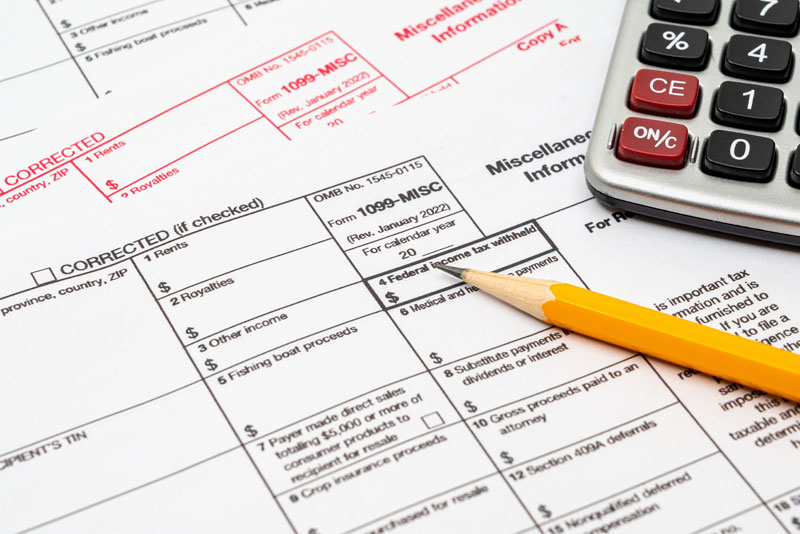

Does an LLC Get a 1099?

Many freelance professionals and independent contractors operate as Limited Liability Companies (LLCs). The requirements for when a business should send a 1099 form to an LLC vary, as does the 1099 form to send. Generally speaking, this is when LLCs should or...

How Much Does it Cost to Incorporate Your Business?

So you’ve decided to register your business as a Limited Liability Company or C Corporation. Kudos to you for thinking about the benefits of liability protection and possible tax advantages that come with formally establishing your company as a separate legal...

Registering a Business Name vs. Trademarking a Business Name

You spend time coming up with the perfect name for your business then you spend lots of money creating business cards, signs, and other marketing collateral. But what happens if someone else is already using that name or the name is soon adopted by another company?...

What Every Small Business Should Know About 1099s

Every year when tax time rolls around, many business owners wonder whether they must send 1099s to their vendors. As commonly known as 1099 forms are, they remain one of the most misunderstood Internal Revenue Service (IRS) requirements. Recently, more confusion...

How to Hire the Right People

At CorpNet, we pride ourselves on having a stellar team of employees. Many of our staff has been with us since we launched in 2009. We treat our staff like family, and in return, they do everything they can to help make CorpNet a success.

How to Encourage Your Kids to Grow Up to Be Entrepreneurs

My kids have taught me some valuable life lessons that I’ve used as an entrepreneur, and I like to think that a lesson or two has rubbed off on me to them. There’s no guarantee that any of my four children will grow up to become small business owners, though I’d...

Can a Corporation Be a Member of a Limited Liability Company (LLC)?

Starting and running a business as a Limited Liability Company (LLC) offers some advantages to business owners who want liability protection, taxation flexibility, and credibility without complexity. Next to a Sole Proprietorship, it’s the business legal structure...

Multiple Ventures? How to Best Structure Your Multi-Brand Business

It's possible to create a separate business entity for each venture you start. However, this can result in excess paperwork and legal filings. And in many cases, each business may not be earning a significant amount of revenue individually, making the paperwork seem especially tedious. To save some headaches and paperwork, this article provides you with great tips to consider when dealing with multiple business types.