The Launch Blog: Expert Advice from the CorpNet Team

12 Steps for Closing an LLC Before Year End

If you’re thinking of closing your LLC before the year ends, you may be feeling overwhelmed. And you are probably wondering what you must do to exit the business without leaving any loose ends behind. Indeed, there is more to shutting down a business than merely...

Maintain Business Compliance to End the Year in Good Standing

As we move into the winter months it's time to begin thinking of year-end business compliance responsibilities and business activities. Business compliance matters to businesses regardless of industry or size and it is something that needs attention every year....

What Taxpayers Need to Know About the IRS’s Extended Tax Deadline

Due to the severe winter weather conditions that impacted much of California and parts of Alabama and Georgia, the tax deadline for 2022 individuals and businesses, the Internal Revenue Service (IRS) extended its tax deadlines to October 16, 2023. Some parts of...

How Do I Maintain a Business?

After a business is up and running, it's critical to maintain it by fulfilling all of the required business compliance tasks on time. Of course, businesses grow and evolve over time, and therefore, the actions they must take to maintain a business entity also may...

12 Steps for Closing a Corporation by Year End

As difficult as it may be to make the decision to close a business, things can become even more challenging if a business’s owners don’t tie up all the loose ends. If you’re thinking of closing your corporation by year-end, realize that there’s more to the process...

How Many LLCs Can You Have?

The Limited Liability Company structure is a popular choice among serial entrepreneurs because it offers the benefits of personal liability protection for the business owner, tax flexibility, and minimal compliance requirements. As an eager and enterprising...

Can an LLC Owner File for Unemployment?

Can an LLC owner file for unemployment? The quick answer is yes, but not in every situation. There are advantages to owning a Limited Liability Company (LLC), with tax flexibility, serving as one of the major benefits. How you elect to structure your LLC for tax...

How to Withdraw Money From an LLC

How does a Limited Liability Company (LLC) owner withdraw money from their business? Whether these funds are for personal use or it is considered compensation from the LLC, how they may do that depends on three things: Whether the Limited Liability Company is a...

Checklist for Launching a New Business in Indiana

Launching a new business in Indiana can be a smart move due to the state’s favorable business environment. Characterized by relatively low corporate taxes, reasonable regulatory requirements, and a comparatively affordable cost of living, Indiana’s central location...

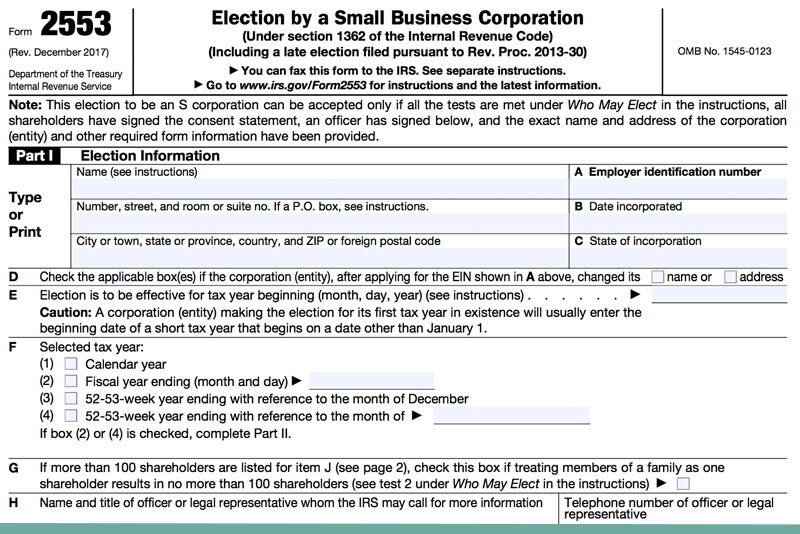

What Is IRS Form 2553?

IRS Form 2553 (Election by a Small Business Corporation) is the form that a corporation (or other entity eligible to be treated as a corporation) files to be treated as an S corporation for federal tax purposes. The IRS has specific criteria that entities must meet...

A Guide for Starting a Business in Colorado

Colorado’s economy is just as varied and unique as its people and landscape. Tourists flock from around the world to experience Colorado’s scenery, recreational adventures, and cultural activities. In addition, Colorado has a long successful history of ranching,...

What Is an Executor of an LLC?

An LLC executor is a designated person or business entity that an LLC’s members appoint to handle certain legal and tax-related aspects of their business at various stages of its existence. An executor might assist LLC members through the business formation...

A Guide for Starting a Business in Maryland

Maryland’s strategic location on the east coast of the U.S. is within easy reach of major metropolitan cities like Washington, D.C., Baltimore, Philadelphia, and New York City. This proximity can give your business access to a large customer base and supply chain...

Why Small Businesses Fail

Owning a small business is the American dream. But sometimes, despite all the hard work, that dream turns into a nightmare and businesses don’t make it. Understanding why small businesses fail can be as crucial as knowing the secrets of those that succeed. Being...

What Is a Certificate of Formation?

If you’re considering starting a business as a Limited Liability Company (LLC), you’ll want to become familiar with the term “Certificate of Formation.” Sometimes called Articles of Organization or Certificate of Organization, a Certificate of Formation is the...

Back to School, Back to Your Business

With autumn approaching, many entrepreneurs and other professionals with school-age children face a double dose of challenges. Back to school brings break-neck fall schedules packed with events and extracurricular activities that demand parents’ time. And as kids...

CorpNet Awarded Inc. 5000 for 2023

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. 5000 list in 2023 as one of the fastest-growing private companies in the country. This is the sixth year CorpNet has been honored and 2023 is the highest ranking to date. CorpNet's Inc. 5000...

What Is an Agent for Service of Process?

An agent for service of process is an individual or business that accepts important legal and government notices on behalf of an LLC or Corporation. More commonly known as a registered agent, designating an agent for service of process is a requirement for LLCs,...

Registered Agent Options for Non-Citizens

If you’re a foreign entrepreneur wishing to start a business in the United States, I expect you may have many questions about the process. Non-citizens can own a U.S-based Limited Liability Company (LLC) or C Corporation, and like U.S. residents, non-resident...

How to Appoint a Registered Agent

Appointing a registered agent for your business entity isn’t terribly difficult, but it does require a little effort on your part. Whether you’re starting a brand new business and need to designate a registered agent for the first time or you want to change your...

What is a Corporate Resolution?

A corporate resolution is a formal record of a corporation's board of directors' decisions and actions on behalf of the company. States require incorporated companies to use corporate resolutions for recording major business decisions. The company's board of directors must vote to approve resolutions either during board meetings or in writing.

Should I Be My Own Registered Agent?

The owner of a Limited Liability Company (LLC) or Corporation might consider being their own registered agent since it eliminates the cost of contracting another party to accept service of process and other official notifications on the business’s behalf. However,...

A Guide for Starting a Business in Michigan

If you’ve been thinking about starting a business in Michigan, you're in good company. With plentiful resources, incentives, and loans, Michigan is home to 902,000 small businesses that represent 48.3 % of the state's workers. Michigan offers one of the best...

What is a BOC-3 Process Agent?

The BOC-3 federal filing designates process agents to accept legal documents on behalf of transportation companies. The process agent company must list the process agents in all other states where the company conducts business.

What Is a Registered Agent?

Many business owners will ask themselves what is a registered agent and then question if they really need one. The answer to both questions is yes! A registered agent is a person or company with the authority to accept service of process (legal documents and...

Time is Running Out on $1 LLC and DBA Filing in Colorado

Since July 1, 2022, the filing fees required to be paid for the registration of new businesses within Colorado have been reduced to $1. This savings includes the formation of a Limited Liability Company (LLC) and initial tradename registrations (DBAs). Colorado...

Time is Running Out on California Waiving Business Formation Filing Fees

Since July 1, 2022, the filing fees required to be paid for the registration of new businesses with the California Secretary of State have been waived. This includes Corporations, Limited Liability Companies (LLCs), and Limited Partnerships (LPs). California’s...

What is a Registered Office?

You'll likely encounter some unfamiliar terms when forming and managing your business. One phrase is a registered office, which refers to the physical address where a company receives service of process, which are legal documents and government notices that need...

What Is LLC Service of Process?

When someone sues an LLC, the procedure of delivering the legal paperwork that initiates the lawsuit and allows it to proceed is referred to as service of process. Service of process notifies the LLC of the lawsuit, and it establishes that the court hearing the...

Tax Saving Features of Corporations, S Corporations, and LLCs

I regularly speak to business owners about entity types and their potential impact from a tax perspective. A while back, I created a webinar for accountants (and other professional services providers that work with businesses) on the topic of business structures...